You will need the:

- California Certificate of Title or Application for Replacement or Transfer of Title (REG 227) (PDF) form.

- Signature(s) of the seller(s), buyer(s), and lienholder (if applicable).

- Transfer fee.

You may also need:

- A Vehicle/Vessel Transfer and Reassignment Form (REG 262).

- A Statement of Facts (REG 256) form.

- A Notice of Transfer and Release of Liability (REG 138) form.

- Smog certification.

- Other less commonly used forms (see below).

- Use tax and/or various other fees.

What Is a Change in Ownership?

Any change of the registered owner or lienholder (legal owner) of a vehicle or vessel is considered a change in ownership and must be updated within 10 days with the Department of Motor Vehicles (DMV). The change is usually due to:

- A sale, gift, donation, or trade.

- Adding or deleting the name of a co-owner.

- An inheritance.

- A satisfaction of lien (full payment of car loan).

Transfer – When there is a change of ownership, DMV refers to the transaction as a “transfer.”

Seller – The person(s) and/or company shown as the registered owner on the Certificate of Title (and DMV’s records) is always referred to as the seller, even if the vehicle is a gift.

Buyer – The person(s) and/or company who is going to become the new registered owner is referred to as the buyer.

What Documents Are Required?

Certificate of Title or Application for Replacement or Transfer of Title (REG 227)

If the title is missing, use a REG 227 (PDF) to complete the transfer of ownership. The seller and buyer complete the title or REG 227. If there is a lienholder, the lienholder’s release must be notarized when a REG 227 is used (notarization is not required for any registered owner, only the lienholder). If the vehicle is 2 model years old or less with a lienholder, a REG 227 cannot be used; a replacement title must be obtained through the lienholder.

Vehicle/Vessel Transfer and Reassignment Form (REG 262)

A REG 262 is required from each seller if the vehicle is sold more than once with the same title, or if an Odometer Disclosure (see below) is require and a REG 227 is being used.

Statement of Facts (REG 256)

A REG 256 (PDF) is completed for:

- Use Tax exemption when the vehicle is obtained from an eligible family member, or as a gift, court order, inheritance, or the addition or deletion of an eligible family member, or the addition or deletion of another person(s) as a gift.

- Smog exemption when the smog certification was used for registration renewal and the last smog certification was obtained within the last 90 days.

- Transfer Only when the vehicle is on Planned Non-Operation (PNO) and vehicle is still non-operated.

Other Less Commonly Used Forms

Application for Replacement Plates, Stickers, Documents (REG 156)

A REG 156 (PDF) is used when the vehicle is missing a license plate or has no license plates, such as when the seller kept their personalized license plates for use on another vehicle owned by the seller.

Certificate of Non-Operation (REG 102)

A REG 102 (PDF) is used to adjust fees (if applicable) when the vehicle is on Planned Non-Operation (PNO) and has not been used; the dates of non-operation must be entered on the form. If the vehicle is still not being operated or has only been moved on a permit, “CURRENT” should be entered in the “To: Month, Day, Year” box on the REG 102 form.

Lien Satisfied/Legal Owner/Title Holder Release (REG 166)

If a legal owner (such as a bank or other financial institution) is on record and a REG 227 form is being used, the legal owner may release their interest on the REG 227 or the REG 166 form.

Statement to Record Ownership/Statement of Error or Erasure (REG 101)

A REG 101 (PDF) is used to explain an error made on the name or other information entered on the title. The REG 101 is completed by the person(s) whose name(s) appears in error or, if other than a name, by the person who made the error. If an error was made on the odometer reading, a REG 262 form signed by both the seller and buyer is also required in addition to the REG 101.

Affidavit for Transfer Without Probate California Titled Vehicle or Vessel Only (REG 5)

A REG 5 (PDF) is used when the registered owner of a vehicle is deceased for 40 days or more, and the value of the decedent’s property in California does not exceed $150,000. The vehicle must be titled in California. An original copy of the death certificate is required when a REG 5 form is used; the original death certificate will be returned to the applicant.

Declaration of Gross Vehicle Weight (GVW)/Combined Gross Vehicle Weight (CGW) (REG 4008)

New owners of commercial motor vehicles with an unladen weight of 6,001 pounds or more (except pickups) must complete a REG 4008 (PDF) form to declare the maximum operating weight of their vehicles with a load.

Odometer Disclosure

Odometer disclosure is on the Certificate of Title. Disclosing the vehicle’s odometer mileage reading is required by federal regulations for all transfers unless the vehicle is:

- 20 years old or older for vehicles 2011 and newer.

- A commercial vehicle with a GVW or CGW of more than 16,000 pounds.

Is a Smog Inspection Required?

When you transfer ownership of a gas-powered vehicle that is 8 or less model years old, a smog certification is not required. However, a smog transfer fee is collected from the new owner. When a gas-powered vehicle that is more than 4 model years old or a diesel-powered vehicle that is a 1998 year-model or newer with a GVW of 14,000 pounds or less is sold, the seller must obtain a smog certification for the transfer unless within the last 90 days a biennial smog certification was obtained. Exempt vehicles:

- 1975 and older year-model vehicle that is gas-powered.

- 1997 and older year-model vehicle that is diesel-powered.

- Diesel-powered vehicle that weighs 14,001 pounds or more GVW.

- Electric-powered vehicle.

- Vehicle equipped with a two-cycle engine.

- Natural gas-powered vehicle that weighs 14,001 pounds or more GVW.

- Motorcycle.

- Trailer.

- Special equipment vehicle.

- Off-highway vehicle.

- Crane.

- Cement mixer.

- Forklift.

- Golf cart.

- Street sweeper originally manufactured as a street sweeper and incapable of use for any other purpose. This does not include a vehicle converted or retrofitted with a vacuum or sweeper.

- Transfer between family members (parent, grandparent, child, grandchild, brother, sister, spouse, or domestic partner) or individual being added as a registered owner. A REG 256 must be completed for the exemption. However, if registration renewal is due, the smog may be required for the renewal.

What Fees Will Be Due to DMV?

When the application is submitted to DMV these fees may be due:

- Transfer.

- Use tax based on the new registered owner’s city and county of residence; use tax is not due if the vehicle is on PNO and Transfer Only is being requested.

Note If the new registered owner’s address is out-of-state and the vehicle is not located in California, the base California Use Tax rate is applied, not the rate of the out of state location. - Registration renewal (if coming due) or planned nonoperation.

- Replacement title if a REG 227 is used.

- Replacement license plate(s) if replacement license plates are needed.

Note The fee is not due if the plates being replaced were Disabled Person, Special Interest, or personalized.

Important Transfer fees are due within 10 days of the “sale” (date of sale, gift, donation, or trade). Penalties are assessed if payment is not submitted to DMV within 30 days of the “sale.” To avoid penalties, fees can be posted while waiting for all necessary documentation or requirements to complete the transaction. If multiple sales occur before DMV is notified, a separate transfer fee is collected for each sale when the transfer application is received by DMV.

Notice of Transfer and Release of Liability (REG 138)

Within 5 days of releasing a vehicle, trailer, or vessel ownership, the seller files a REG 138 (PDF) with DMV online or downloaded and mailed to the address on the form.

Important The REG 138 relieves you of responsibility for parking and/or traffic violations and civil or criminal actions involving the vehicle after your date of sale. However, your name is not removed from DMV records until the new owner submits the vehicle title to DMV for transfer of ownership, pays the appropriate fees, and completes all transfer requirements.

Frequently Asked Questions

Do I need to attach proof of the sale, bill of sale, or other documentation to the REG 138?

No. Any attachments to the REG 138 will not be reviewed, kept, or returned, and will be disregarded.

Does the buyer need a copy of the REG 138, or does the REG 138 Have to be on file with DMV before DMV will transfer the vehicle?

No.

How do I determine a selling price for my vehicle?

Check similar vehicles in newspapers, online, vehicle dealerships, and in value/pricing guides available at the library.

What do I do with the license plates when I sell my car?

Most vehicles have sequentially issued “standard” license plates that remain with the vehicle when ownership is transferred. Disabled person, special interest, or personalized license plates belong to the plate owner, not the vehicle. As the seller of a vehicle with disabled person, special interest, or personalized license plates, you must remove the plates. If you wish to release your interest in the special interest or personalized license plates to the new owner, complete a Special Interest License Plate Application (REG 17 (PDF)) form releasing your interest and give the form to the buyer.

How long will it take for the sale to be complete?

When you give the buyer all the required documentation and DMV receives your completed REG 138; the seller’s part of the transaction is complete. Once the buyer provides DMV with all the proper documents, fees, and all the requirements are met (including smog certification, if applicable), the vehicle record is updated to reflect the change of ownership (your name is removed at that point), and a registration card is issued. A new title is issued within 10-15 calendar days.

Will I have to pay for anything after I have sold my vehicle?

All the transfer fees are the responsibility of the buyer.

Should I keep any papers after the vehicle is transferred?

Keep a copy of the completed REG 138.

Do I owe taxes on the money I receive for the sale of my vehicle?

Contact your tax advisor.

What is the difference between “or” and “and” between owner names on a title?

When the names are joined by the word “or,” one owner can sell the vehicle without the other’s signature. The word “and” or a slash (/) requires the signature of each owner to sell the vehicle.

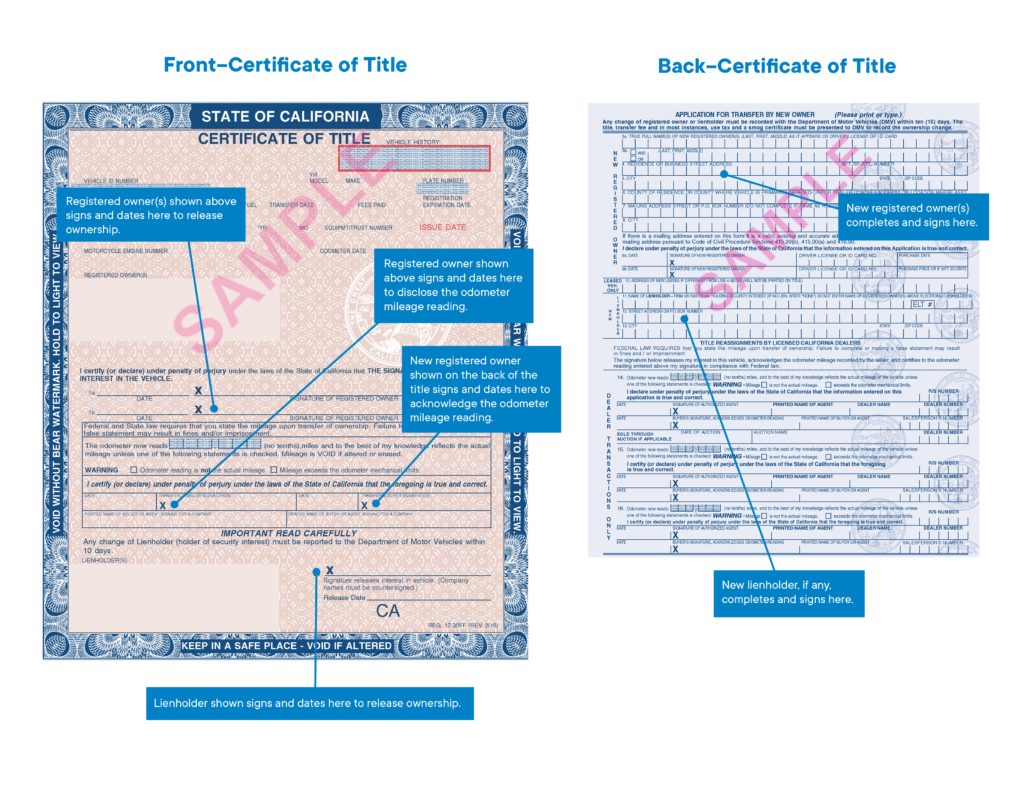

Where do I Sign?

The example below indicates where to complete the current California Certificate of Title.

On front: Lienholder (only if a lienholder is shown) signs and dates here to release ownership.

Note When only deleting a lienholder, the registered owner(s) does not sign line 1A/1B and does not complete lines 3A-13.

On back: New lienholder’s name (such as a bank or other financial institution), if any, is printed here.

HTVR 32 (REV. 6/2022)