Chapter 7: IRP Supplement Applications

7.000 – WHEN TO SUBMIT AN IRP SUPPLEMENT APPLICATION

A supplement application is required for the following transactions:

- Name Change.

- Cab Card Corrections (address changes/other corrections).

- Add Vehicle or Add Vehicle with Replacement Credit.

- Delete Vehicle.

- Change Carrier Type/Commodity Class.

- Weight Group Change.

- Replacement Credentials.

- Amended Vehicle.

- Fleet to Fleet Transfer.

- Change of Registration Service Agent Authority.

7.005 – APPLICATIONS SUBMITTED WITHIN THIRTY DAYS OF EXPIRATION DATE

Supplements for any type of fleet changes submitted within thirty days of expiration date for which no subsequent registration year fees are paid for the affected vehicles, will only be issued operating authority to the current fleet expiration date.

7.010 – NAME CHANGE

If a fleet’s registrant name is changed during the current registration year or at the time of filing a renewal application, the department’s records must be corrected to reflect the change.

Changes are reported using the Schedule A/B and a Statement of Facts (MC 256M I). Mark the appropriate space at the top left of Schedule A/B to indicate the application is for carrier information changes.

7.015 – CAB CARD CORRECTIONS

The owner of an apportioned fleet must notify the department within 10 days (CVC Section 4159) of any business and/or mailing address changes or corrections. Notification must be made in writing on a Schedule A/B. Mark the appropriate space provided at the top left of Schedule A/B to indicate the application is for carrier information changes.

New cab cards will not be issued for address changes. Line through the incorrect address information shown on each cab card and print the correct information. A change to the business address will require submission of new basing documents as described in Chapter 4, Section 4.020 of this handbook.

If owner submits a supplement application for a VIN correction, a form of VIN verification must be submitted as described in Chapter 4, Section 4.035 of this handbook. A fee will be required for issuance of a new cab card.

7.020 – ADD VEHICLE OR ADD VEHICLE WITH REPLACEMENT CREDIT

A Schedule C is required to add and/or delete vehicles from an existing California based IRP fleet. All vehicles being added to a fleet must be clear of any preexisting law enforcement violations or restrictions and IRP lien perfections. The following items may also be required:

- Proof of payment or exemption of FHVUT.

- Vehicle Identification Number verification.

If the registrant is a motor carrier lessee registering vehicle(s) under a lease agreement with one or more owner-operators, a copy of the lease agreement, the owner operator’s USDOT Number and Taxpayer Identification Number is required for each leased vehicle registered in the fleet.

California allows the unused full month weight fees (excluding the CVRA fee) for a vehicle deleted from a fleet to be credited to a vehicle concurrently added to the same fleet.

Note A vehicle added to a fleet in which it was previously deleted is required to pay a full year of registration fees.

7.025 – DELETED VEHICLE

A Schedule C is required to delete vehicles from an existing California based IRP fleet.

The license plate(s) and cab card of each vehicle being deleted must be surrendered at the time it is deleted from the fleet. If the carrier does not surrender the license plate(s) and cab card(s), the vehicle(s) will not be deleted and will be included in the renewal listing. If a carrier is unable to surrender the license plate(s) and cab card; a Statement of Facts (REG 256) (PDF) stating the license plate(s) and cab card have been destroyed, lost or stolen is acceptable.

Unused California fees will not be refunded when a vehicle is deleted from a fleet. Carriers must apply directly to each jurisdiction to request a refund of fees.

7.030 – WEIGHT GROUP CHANGE (INCREASE/DECREASE)

A Schedule C is required to change the operating weight of a vehicle in an existing California based IRP fleet. In cases were the weight increase will result in the vehicle being operated at 55,000 pounds or more combined gross vehicle weight, a Schedule 1, Form 2290 showing evidence of full payment or exemption of Federal Heavy Vehicle Use Tax (FHVUT) may be required.

For weight increase applications apportioned fees for each affected jurisdiction will be assessed based on the difference between the original reported weight and the increased weight desired.

Payment of the total actual apportioned amount of fees due for all affected jurisdictions in which the weight is increased is required. In addition to any other California weight fee due, a cab card fee, weight decal fee (if the weight ranges from 10,001 – 80,000 lbs.), and application fee, will be required.

If full payment is not submitted with the application, the balance due will be reported to the applicant on a billing invoice. Any additional fees due must be paid within 20 days of the date of the invoice to avoid penalties.

Operating indicia will not be issued until the total fees due, as computed by the department, are paid in full.

Weight decreases which result in the vehicle changing from the gross vehicle weight category to a unladen weight fee category with a higher rate of weight fee, will be assessed the difference between the higher and lower weight fees for the remainder of the registration period.

Fees paid for the higher weight classification in California or any other IRP jurisdiction will not be refunded and the customer may not use the vehicle’s original qualifying higher weight classification if the vehicle is subsequently deleted and used as weight replacement credit toward another vehicle added to the fleet.

In addition to any other California weight fee due, a cab card fee, weight decal fee (if the weight ranges from 10,001 – 80,000 lbs.), and application fee, will be required. Any additional fees due must be paid within 20 days of the date of the invoice to avoid penalties.

Operating indicia will not be issued until the total fees due, as computed by the department, are paid in full.

7.035 – REPLACEMENT CREDENTIALS

A completed supplement application, Schedule C is required when requesting replacement to replace lost, stolen, or mutilated license plates, stickers, weight decals, weight decal year stickers, or cab cards.

In the case of replacement license plates, any remaining license plates and the cab card must be surrendered with the application. If unable to surrender the license plate(s) and cab card, a Statement of Facts (REG 256) (PDF) stating the disposition of the item(s) is acceptable.

Replacement license plates are no longer issued in field offices. The IRP Operations Section will process the application and issue new plates. If the application is submitted by an employee of an authorized registration service, the application must contain the agent’s occupational license number and expiration date.

7.040 – AMENDED VEHICLE

An amend vehicle supplement should be submitted when making a correction of vehicle information. Amend vehicle changes include:

- Vehicle Identification Number (VIN)

- Make

- Year Model,

- Body Type

- Number of Axles

- Number of Combined Axles

- Fuel Designation

- Unladen Weight,

- Weight Group

- Purchase Price

- Factory Price

- Purchase Date.

The change may result in an increase or decrease of fees due. A fee for issuance of a new cab card and an application fee will be required. If additional fees are due, they will be reported to the applicant on a billing invoice. Any additional fees due must be paid within 20 days of the date of the invoice to avoid penalties.

7.045 – FLEET TO FLEET TRANSFERS

A Schedule C is required in order to transfer a vehicle from one fleet to another fleet in the same account. The information on both fleets must be the same, including the expiration date. The carrier may retain the same plates for this transaction.

Fees are due when transferring a vehicle from fleet to fleet; California does not provide credit when processing a fleet to fleet supplement transaction.

7.050 – CHANGE OF REGISTRATION SERVICE AGENT AUTHORITY

IRP registrants must notify the IRP Operations Section when there is a change to the applicant’s authorization for representation for IRP registration purposes by a registration service agent. Registration Services must notify the IRP Operations Section when they no longer represent an IRP registrant.

Chapter 6: IRP Renewal

6.000 – INTRODUCTION

This chapter covers the general requirements and information applicable to IRP renewal. The department sends out a renewal documents to all active IRP registrants that have an account in good standing.

6.005 – IRP RENEWAL DOCUMENTS

Page 1 – Schedule A – Carrier Information: Identifies the business entity as recorded in the California DMV IRP computer system. If corrections or changes to the information are necessary, enter the corrected information under column B in the blank spaces to the right of the printed information. The form must be signed and dated.

A Statement of Facts, Motor Carrier Fleet Name Change (MC 256M I) form is required when making a change or correction to the business name.

When reporting a change to the business (physical) address, please provide a copy of your rental or lease agreement or a copy of your mortgage documents.

If the carrier’s USDOT number and/or Taxpayer ID number is not listed on the Schedule A, the carrier must provide this information in Column B.

Page 2 – Schedule A – Carrier Information/Registration Service Agent Authorization: Identifies the registrants authorized registration service agent, type of operation, and commodity class. Indicate any changes or corrections in Column B. This section must be completed and signed by an authorized employee of the registrant or an authorized employee of the appointed registration service agent.

Registration service agent authorization is only valid for the calendar year for which authorization was issued and must be renewed each year. If a registration service agent will be authorized to complete and submit IRP applications for the IRP registrant for the current registration year, the authorization section must be completed and signed by an authorized employee of the IRP registrant. Notify the IRP Operations Section immediately in writing when an agent is no longer authorized to handle your account.

Important Registration service agents must provide their occupational license number and expiration date.

Page 3 –Schedule B – Mileage Information: The information entered on this page determines the computation of distance percentage and registration fees for each qualified IRP jurisdiction. Renewal distance percentages are always based on the historical distance traveled in each jurisdiction during the distance-reporting period. Actual distance must be listed.

Interstate distance accrued by trip permit or alternative jurisdiction IRP base registration must be reported as actual distance.

Page 4 – Renewal Summary/Fee Reconciliation: Complete this page to record adjustments to the preprinted vehicle totals and compute the fees due. Indicate vehicles added or vehicles deleted for renewal and adjust fees accordingly as shown below:

| LINE | INSTRUCTIONS |

|---|---|

| LINE1 | INSTRUCTIONSPreprinted with 100% California Fees due for all vehicles preprinted on Pages 5 and 6 (if applicable). |

| LINE2 | INSTRUCTIONSEnter the total 100% California fees for each vehicle added to the fleet within 45 days from the renewal expiration date or for pending supplement vehicle adds. |

| LINE3 | INSTRUCTIONSEnter deleted vehicles (subtract from total 100% fees due). |

| LINE4 | INSTRUCTIONSOptional Payment – Show the adjusted amount of 100% California fees due here, or |

| LINE5 | INSTRUCTIONSOptional Payment – *Line 4 times (X) CA % |

| LINE6 | INSTRUCTIONS*Foreign IRP Jurisdiction Fees, or |

| LINE7 | INSTRUCTIONSEnter the total per vehicle cab card fees |

| LINE8 | INSTRUCTIONSPreprinted Application fee |

| LINE9 | INSTRUCTIONSEnter the total of lines 4, 7, and 8, or |

| LINE10 | INSTRUCTIONSEnter the total of lines 5, 6, 7 and 8, or |

*A copy of the billing from the registrant or registration service agent’s system software that was utilized to calculate fees for CA and other jurisdiction(s) must be submitted with the application.

Additional Payment Options:

• $250 per vehicle per month, or

• $300 per vehicle per month (only if purchase price is $200,000 or more)

6.010 – NONRECEIPT OF IRP RENEWAL DOCUMENTS

If the IRP renewal documents are not received, the carrier may apply for renewal by submitting the following:

- Schedule A/B

- Schedule C

- VIN Verification (If adding a vehicle or making a correction)

- Proof of payment or exemption of FHVUT (If applicable)

- Agreement to Maintain Records

- Agent authorization (If applicable)

- Lease agreement (If applicable)

- Proof of insurance

6.015 – ABSENCE OF INTER-JURISDICTIONAL MOVEMENT

Apportioned vehicles must travel in two or more member jurisdictions. Vehicles solely operating in California or in any one jurisdiction are not eligible for apportioned registration, unless intent to travel interstate can be established. “Intent” will be established by records of travel and verifiable contracts. Vehicles found to be solely operated in California should apply for regular commercial registration. Those operating in any one jurisdiction should apply for registration in the jurisdiction in which the vehicle is being operated.

The Plan, Article II official commentary states, in part, the fact that a vehicle is not used in more than one jurisdiction for the entirety of a registration year and for six additional months gives rise to a presumption that the registrant did not intend to use the vehicle in more than one member jurisdiction.

6.020 – PROCESSING PRIORITIES

Applications received by the IRP Operations Section are processed in order of the date received. The department may appropriate a portion or all of the renewal fees paid on an account in order to complete the processing of applications previously submitted that have a balance of fees due or audit fees due.

6.025 – PAYMENT OF FEES AND PENALTIES (CVC SECTION 9554)

The payment amount that must be submitted is shown on the Renewal Summary Page. Apportioned registration renewal fees due must be postmarked or submitted no later than midnight of the fleet’s current registration expiration date. Failure to pay fees by the current registration expiration date will result in the assessment of penalties on the California renewal fees.

Renewal applications may not be submitted with California apportioned fees only. Failure to submit fees in all qualified foreign IRP jurisdictions subjects the fleet vehicles to violation in any affected IRP jurisdiction(s) including California.

6.030 – LATE RENEWALS (CVC SECTIONS 4604.2 (c), 4604.5 (b))

Late renewals are subject to the assessment of fees and penalties. A Certificate of Non-Operation (CNO) will not reduce the amount of the registration fees required on renewal applications.

A CNO submitted with renewal documents may be accepted for 90 days following the IRP registration expiration date for waiver of penalty fees only, providing the vehicle(s) was not operated after the expiration date. For customers submitting a CNO on day 91 or later penalty fees may be assessed.

Planned Non-Operation (PNO) does not apply to vehicles registered under the IRP.

6.035 – WITHDRAWN OR DELETED VEHICLES (PLAN SECTION 615)

The IRP renewal fleet listing and request for a withdrawn or deleted vehicle(s) must be received on or before the current expiration date to avoid registration fees for the following year. The license plate(s) and cab card(s) for the withdrawn or deleted vehicle(s) must be surrendered to the department or renewal fees and penalties will be assessed for the withdrawn or deleted vehicles(s).

If a vehicle is withdrawn or deleted from the fleet after the renewal application is submitted, a supplement application is required. If the vehicle has been operated after the expiration date, the vehicle will not be withdrawn or deleted and the renewal billing will include registration and late penalty fees for the vehicle. A refund will not be issued.

6.040 – EVIDENCE OF FINANCIAL RESPONSIBILITY (CVC SECTION 16500.5)

Each IRP registrant is required to submit proof of valid public liability insurance with their renewal application. The department requires the applicant to submit one of the following as proof:

- An International Registration Plan (IRP) Certificate of Insurance Form (MC 5009 IRP) (PDF) completed by your insurance company.

Or

- Evidence of Insurance containing the following information:

- The name and address of the vehicle owner or fleet operator.

- The name and address of the insurance company or surety company providing a policy or bond for the vehicle.

- The policy or bond number with the effective date and expiration date.

- A statement from the insurance company or a surety bond company stating the policy or bond meets the requirements of CVC Sections 16056 or 16500.5 and is a commercial or fleet policy. One form may be submitted per fleet as specified by the department.

California IRP cab cards will not be issued for any fleet that is not in compliance with the proof of insurance requirement.

6.045 – FEDERAL HEAVY VEHICLE USE TAX (FHVUT) (CVC SECTION 4750)

Commercial motor vehicles or buses that operate at 55,000 pounds or more combined gross vehicle weight (CGW) must have evidence of full payment of, or exemption from, the FHVUT before the vehicle can be registered. The FHVUT tax year is July 1 to June 30.

A vehicle with a registration expiration month other than July, August, or September is required to provide proof of payment documents for the current FHVUT tax year. Vehicles with an expiration month of July, August, or September can provide proof of payment documents from the immediate previous FHVUT tax year.

Note The IRS requires taxpayers to e-file Schedule 1, Form 2290 when filing with 25 or more vehicles. A electronically watermarked Schedule 1, Form 2290 is returned to the taxpayer as proof of payment.

Acceptable Proof of Payment – Any of the following may be submitted as proof of FHVUT payment:

- Original or photocopy of Schedule 1, Form 2290 electronically watermarked or manually stamped by the IRS.

- A photocopy of Schedule 1, Form 2290, filed with the IRS and a photocopy of the front AND back of the canceled check for the entire FHVUT payment payable to the IRS

Acceptable Proof of Exemption – An original or photocopy of an IRS receipted Schedule 1, Form 2290 (electronically watermarked or manually stamped), listing the vehicle as exempt.

The document(s) submitted and any watermark or stamp appearing on it must be legible.

Any questions regarding specific tax regulations or completion of the Schedule 1, Form 2290 should be directed to the IRS.

Proof of Payment of FHVUT is Not Required –

The following are the only acceptable situations where proof of payment of FHVUT is not required:

- When a vehicle is qualified for California and all qualified foreign IRP jurisdictions at a maximum operating weight of 54,999 pounds or less or,

- If an application for registration or transfer of a new or used vehicle is submitted in the new owner’s name within 60 days of the date of purchase or transfer or,

- If a vehicle has a valid alternative form of California registration which is being converted to IRP registration.

Important California IRP cab cards will not be issued to a fleet that is not in compliance with the requirement to submit poof of payment or exemption of Federal Heavy Vehicle Use Tax.

6.050 – AGREEMENT TO PREPARE AND MAINTAIN RECORDS AND REPORT INFORMATION IN ACCORDANCE WITH INTERNATIONAL REGISTRATION PLAN AND CALIFORNIA APPORTIONMENT REQUIREMENTS MC 522 I

(CVC SECTION 8057; PLAN ARTICLE X)

All IRP applicants are required to read, understand, and adhere to the record keeping provisions of the Plan. The specific record keeping requirements are printed on this form and the form must be completed and signed by an authorized company official before any California IRP operating authority is granted to the applicant. A registration service agent may not sign this form.

Failure to maintain records according to the provisions of the Plan and the California Vehicle Code may result in the assessment of substantial fees, interest, and penalties

6.055 – OWNER RESPONSIBILITY CITATIONS (CVC SECTIONS 40001 and 40002.1)

In order to clear an owner responsibility citation from the DMV record, the customer must submit an “Abstract of Court Release Adjudication” (DL106R) completed by the issuing court for each owner responsibility citation listed. A service fee of $7 for each citation will be added to the total fees due.

6.060 – PARKING VIOLATIONS (CVC SECTION 40200)

Parking violations can only be cleared from the DMV record if the customer submits an “Abstract of Court Release” issued by the court or parking agency of adjudication or the full bail amount is submitted to DMV.

Chapter 5: IRP Registration Fees

5.000 – PAYMENT OPTIONS

Fees submitted by the registrant or their authorized agent for IRP applications must be calculated in one of the following ways:

- Full (100%) California fees, OR

- *CA Apportioned Fees + Other Jurisdiction Fees, OR

- $250 per vehicle per month for the number of months between the application date and expiration date, OR

- $300 per vehicle per month (purchase price of $200,000 or more) for the number of months between the application date and expiration date.

*A copy of the billing from the registrant or registration service agent’s system software that was utilized to calculate fees for CA and other jurisdiction(s) must be submitted with the application.

5.005 – PAYMENT METHODS

A cashier’s check, money order, or a personal or company check is acceptable methods of payment; unless a dishonored check was submitted for payment of fees on the apportioned account. If a dishonored check was submitted for payment, certified funds, i.e. cashier’s check or money order, is required to clear the dishonored check.

5.010 – PAYMENT BY DISHONORED CHECK

IRP applications paid by a check that are subsequently dishonored by the bank are subject to the applicable rate of penalties according to the date of repayment. In addition to penalties, a returned check fee will be assessed to the transaction.

5.015 – CALIFORNIA FEE SCHEDULE

The California Fee Schedule is posted on the DMV website.

Rounding Rules:

- Any fee in the amount of $0.01 to $0.99 round up to $1.00.

- Any fee more than $1.00 with cents totaling from $0.01 to $0.49 round down to the nearest whole dollar.

- Any fee more than $1.00 with cents totaling from $0.50 to $0.99 round up to the nearest whole dollar.

The above rounding rules are to be applied to the California Vehicle License Fee (VLF) prior to determining the full California fee, and then again to the California apportioned fee after applying the mileage percentage.

THE INTERNET FEE CALCULATOR IS AVAILABLE TO DETERMINE CALIFORNIA FULL FEES (DMV.CA.GOV). A CALIFORNIA ZIP CODE WILL BE REQUIRED (EXCLUDE USE TAX).

5.020 – APPORTIONED FEES OR FULL CALIFORNIA FEES

Under the Plan, vehicle registration fees are apportioned based on the miles traveled in each jurisdiction. The plan specifies the base jurisdiction may assess 100% fees when the vehicle does not qualify for IRP registration.

5.025 – INVOICE STATEMENT

When an IRP application is processed an invoice statement indicating the amount due, any prior payments, and balance due, if any. Once an invoice statement has been issued, IRP indicia will not be issued until all fees are paid in full. In order to avoid lapses in valid registration authorization, registration agents and customers are required to remit full apportioned registration fees due.

Balance due payments submitted to the IRP Operations Section in Sacramento by mail or by overnight courier service must be in the form of a check (personal or company checks) or money order.

Please review all billings carefully and notify the IRP Operations Section at (916) 657-7971 of any discrepancies.

5.030 – SANCTIONS FOR FAILURE TO PAY FEES (CVC SECTIONS 8201 & 8203)

Failure to pay fees due may result in one or a combination of the following actions:

- A lien being placed upon all vehicles operated as part of the fleet and on any other fleet vehicles operated by the registrant.

- Suspension of apportioned registration

- Seizure and sale orders for all vehicles operating as part of the fleet or owned by the registrant.

- Civil action.

5.035 – CALIFORNIA IRP FEE STRUCTURE

California IRP vehicle fees are assessed based on two distinct categories as follows:

Category #1

This category identifies the fees for power vehicles operating at a gross/combined gross weight (G/CGVW) of 10,000 pounds or less:

- Registration Fee (CVC Sections 9250, 9250.1,9250.8 & 9250.13): This fee is mileage apportioned; but, is not proportioned based on the number of months of registration.

- Vehicle License Fee (VLF) (Revenue & Taxation Code (RTC) Section 10751): This fee is mileage apportioned and is proportioned based on the number of months of registration. This fee is determined based on the vehicle purchase price and purchase date to the current owner.

- Unladen Weight Fee (CVC Section 9400): This fee is variable based on the number of axles and unladen weight of the vehicle. The fee is mileage apportioned and is proportioned based on the number of months of registration.

- County Fees (Various CVC Sections): These fees are mileage apportioned and vary based on the county of business address location. The fees are not proportioned based on months of operation. For participating county fee information visit the department’s website.

- Reflectorized License Plate Fee (CVC Section 4850): This fee is only assessed when new IRP plates are issued.

- IRP Application Fee (CVC Section 9250.15): This fee is assessed on original, supplement, and renewal applications. The fee is not mileage apportioned and is not proportioned based on the number of months of registration.

- IRP Credential Fee (CVC Section 9259): This fee is required for each vehicle listed on an original, renewal and supplemental application in which indicia is issued. This fee is not mileage apportioned and is not proportioned based on the number of months of registration.

Category #2:

This category identifies fees for power vehicles operating at a gross/combined gross weight (G/CGW) of 10,001 pounds or more. These vehicles are assessed the following fees:

- Registration Fee (CVC Sections 9250, 9250.1,9250.8 & 9250.13): This fee is mileage apportioned; but, is not proportioned based on the number of months of registration.

- Vehicle License Fee (VLF) (RTC Section 10751-37027);

This fee is mileage apportioned and is proportioned based on the number of months of registration. This fee is determined based on the vehicle purchase price and purchase date to the current owner.

- Commercial Vehicle Registration Act (CVRA) Fee

(CVC Section 9400.1): This fee is part of the weight fees. It is mileage apportioned; but, is not proportioned based on the number of months of registration.

- Gross Vehicle Weight Fee (CVC Section 9400.1): This fee is variable based on the applicant’s declared G/CGW. The fee is mileage apportioned and is proportioned based on the number of months of registration.

- Cargo Theft Interdiction Program (CTIP) Fee)

(CVC Section 9400.1 (d) (1-4)): This fee is mileage apportioned; but, is not proportioned based on the number of months of registration.

- County Fees (Various CVC Sections): These fees are mileage apportioned and vary based on the county of business address location. The fees are not proportioned based on months of operation. For participating county fee information visit the department’s website.

- Reflectorized License Plate Fee (CVC Section 4850 (c)): This fee is only assessed when new IRP plates are issued and is; therefore, not assessed on IRP renewal transactions.

- IRP Application Fee (CVC Section 9250.15): This fee is assessed on original , supplement , and renewal applications. The fee is not mileage apportioned and is not proportioned based on the number of months of registration.

- IRP Credential Fee (CVC Section 9259): This fee is required for each vehicle listed on an original, renewal and supplemental application in which indicia is issued. This fee is not mileage apportioned and is not proportioned based on the number of months of registration.

- Weight Decal Fee (CVC 9400.1 (f) (1 & 2)): A weight decal and year sticker will be placed on each commercial vehicle subject to weight fees pursuant to the CVRA. Each vehicle will be issued the weight decals/stickers upon registration or a change in the declared weight is reported.

5.040 – CALIFORNIA UNLADEN/GROSS/COMBINED GROSS WEIGHT FEE

Use the California Fee Schedule located on the department’s website to find the appropriate weight fee. Page 1 of the fee schedule shows the unladen weight ranges and fees for two axle and three or more axle vehicles. Page 2 of the fee schedule shows the Gross and Combined Gross weight ranges and fees.

To find the weight fee for an original IRP registration application, locate the vehicle’s weight range on fee schedule. The amount shown in the column immediately to the right of the weight range is the weight fee.

To find the weight fee for an add vehicle application, identify the numbered month in the registration period in which the vehicle is being added. Find the vehicle’s weight range on the fee schedule. Scroll across until you reach the month column on the fee schedule that matches the month the vehicle is being added.

5.045 – CALIFORNIA VEHICLE WEIGHT INCREASE/DECREASE APPLICATIONS

Applications to increase or decrease California qualified weights for fleet vehicles must be accompanied by the apportioned amount of fees due based on the difference between the old and new weights, the apportioned amount of fees due for vehicle for each foreign jurisdiction the weights being increased, cab card fee for each vehicle, application fee, and weight decal fee if applicable.

In instances where the increase in weight is from the unladen weight category to the gross weight category and the unladen weight fee is higher and was paid first, the gross weight fee will not be refunded or subsequently credited at the higher rate if the vehicle is used for replacement credit.

Please refer to the department’s website for the current California fees and to the affected jurisdiction’s website to obtain fee and instructions on calculating the apportioned weight fee amount.

5.050 – CALIFORNIA CONVERSION CREDITS

Vehicles that are added to fleets during the period for which they are currently registered under California full annual or partial year registration will be granted conversion credits for the months remaining in the paid registration period.

California fees are computed and collected only for those months between the expiration date of the previous full annual or partial year registration and the last day of the current registration year. Credit for months paid into the subsequent registration year will automatically be granted and factored into the California fee calculations printed on the renewal fleet listing. Other IRP jurisdiction fees are computed and collected from the date the vehicle(s) is added to the fleet.

Months in which the full 100% California fees have already been paid will not be adjusted, credited, or refunded based on the mileage percentage of the fleet on which the vehicle is being added.

5.055 – CALIFORNIA WEIGHT FEE REPLACEMENT CREDITS (PLAN SECTIONS 440, 700; CVC SECTION 9408)

California allows the unused full month weight fees (excluding the CVRA fee) for a vehicle deleted from a fleet to be credited to a vehicle concurrently added to the same fleet. Unladen weight fee or GVW/CGW credit is subject to the following requirements/conditions:

- The CVRA Fee is not creditable to a replacement vehicle. Wherever credit of GVW/CGW fees is mentioned in the remainder of this handbook, the fact that the CVRA Fee portion of the weight fee is not creditable is assumed.

- Vehicle must be deleted and added concurrently to the same fleet.

- The maximum credit that may be given to a replacement vehicle is the amount of the weight fee, prorated from the month following the month of withdrawal. The added vehicle is always assessed weight fee for the month the vehicle is added.

- Payment of the required fee for issuance of new registration.

- Gross Vehicle Weight fees can be credited to a vehicle subject to unladen weight fees and unladen weight fees may be credited to a vehicle subject to gross vehicle weight fees subject to all other conditions stated in this section.

- The vehicle being deleted must be “withdrawn from service” in the IRP fleet for the remainder of the fleet’s registration year.

- The vehicle being deleted must be reported on the same supplement application (Schedule C) as the vehicle being added to which the credit will be applied (concurrent addition/deletion).

- The license plates, license plate sticker, and cab card for the withdrawn vehicle must be surrendered to the Department with the application for concurrent vehicle addition/deletion. If plates and/or cab cards were not surrendered, a Statement of Facts must be submitted indicating reason for non-surrender of indicia.

- The unused/excess portion of any weight fee that is credited to another vehicle is not refundable. Unused fee credits are forfeited. For instance, if an unladen weight or gross vehicle weight fee is credited from a vehicle with a higher unladen or gross vehicle weight value to a vehicle with a lower unladen or gross vehicle weight fee value resulting in a non – credited weight fee difference, that difference is not refundable.

- Vehicles that were converted to IRP from California intrastate registration may not be used as credit toward another fleet vehicle during the period of time that the intrastate registration is still valid.

- A vehicle weight credit cannot be used twice in the same registration year. If a vehicle converts from full year registration to IRP and is then deleted in the same registration year, the California weight credit cannot be used again.

- IRP registrants with multiple fleets under the same business entity may only receive weight replacement credits on vehicles that are newly acquired through original purchase or lease. Replacement credits will not be allowed when transferring existing fleet vehicles between multiple fleets of the same registrant.

5.060 – FOREIGN IRP JURISDICTION FEE SCHEDULES

Foreign IRP jurisdiction fee schedules and other information can be obtained by visiting the individual jurisdiction website or from the IRP Inc. website at: http://www.irponline.org.

5.065 – FOREIGN JURISDICTION VEHICLE WEIGHT INCREASE APPLICATIONS

When requesting an increase in the vehicle weight for any foreign jurisdiction, the applicant must calculate the additional apportioned fee amount required for the jurisdiction(s). If the California weight is not changing, the credential and application fee shall be added to application. Once the weight increase application is received by the IRP Operations Section the calculated fees will be reviewed. If additional fees are due it will be reported to the applicant on a billing invoice. Any additional fees due must be paid within 20 days of the date of the invoice to avoid penalties.

5.070 – FOREIGN IRP JURISDICTION REPLACEMENT CREDIT

Many of the IRP Member Jurisdictions give full or partial replacement credit for a vehicle deleted from the fleet to a vehicle added to the fleet.

In order to receive replacement credit California requires, in every case, that the deleted and added vehicles be reported concurrently on the same supplement and credentials for the deleted vehicle must be surrendered with the application.

Important Credit and refund policies are established through individual jurisdiction statutes. Current credit refund information for member jurisdictions may be found on the IRP Inc. website at: http://www.irponline.org.

5.075 – CALIFORNIA VEHICLE LICENSE FEE (VLF)

VLF is determined based on the cost or purchase price and purchase date indicated on the certificate of cost, bill of sale, or titling document submitted with the application.

Depreciation Schedule— In accordance with RTC §10753.2(c) the market value of a vehicle for each registration year of its life, starting with the first year as a new vehicle or first classification year for VLF purposes, will have an eleven year depreciation schedule.

To compute the VLF follow the instructions provided on page 3 of the California Fee Schedule located on the department’s website.

5.080 – PENALTIES: NEW CARRIER, NEW FLEET OR SUPPLEMENT APPLICATIONS (CVC SECTION 9553.5)

Penalties are due whenever fees have not been paid in full for an application for registration of an apportioned vehicle. The registrant shall have 20 days from date of notice by the department to pay the balance of the fees. If the balance due is not paid within the 20 days, the application is subject to penalties.

5.085 – REPLACEMENT INDICIA

A fee may be assessed for replacement indicia i.e. cab card, license plate(s) stickers, etc.

5.090 – REFUNDS (CVC SECTION 42231)

The department issues refunds of California fees paid only if the fees were paid in error or if excess fees were paid. An Application for Refund (ADM 399) must be completed and mailed to the IRP Operations Section in Sacramento.

Note California does not refund fees paid to other IRP jurisdictions. Carriers must apply directly to and satisfy each jurisdiction’s requirement(s) for refund of fees.

5.095 – COLORADO LOW MILEAGE FEE REDUCTION

The State of Colorado assesses a lower rate of registration fees to power units that are operated nationally 10,000 miles or less annually. In order to qualify for assessment at the lower rate you must have a full 12 consecutive months of mileage records as substantiated by Individual Vehicle Mileage Records (IVMR) for the qualifying vehicle.

For more detailed information regarding the low mileage fee reduction contact the State of Colorado.

5.100 – COLORADO RENTAL/LEASEING COMPANIES

If a rental/leasing company rents a vehicle for a period less than 45 days and never travels in Colorado during the registration term, the vehicle is not charged apportioned Colorado Ownership Tax. For vehicle rentals of 45 days or longer, registration fees and ownership tax will be collected in accordance with Colorado’s fee chart.

A Colorado Rental/Leasing Data Form (MC 143 I) must be completed and returned with your IRP application if you have rental vehicles that rents for a period of less than 45 days and never travel in Colorado during the registration term.

If vehicles are rented in the State of Colorado for a period of less than 45 days during the registration year, the owner will be charged 2% of the amount of the rental payment of Colorado Ownership Tax payable to the Colorado County where the rental took place (Colorado Ownership Tax is only charged on these specific vehicle if they are rented in Colorado.) It is the owner’s responsibility to report and pay the 2% of the amount of the rental payment to Colorado.

5.105 – ARIZONA REDUCED RATE FEES

Arizona grants a fee discount to vehicles which meet very specific operational criteria as follows:

One Way Hauling: At least 45% of the mileage during the registration year is traveled without a load.

Route Truck: The vehicle weighs more than 26,000 lbs. and begins and ends a trip at the same point without adding to the load. At the midway point, the load is less than 45% of full capacity of the vehicle.

Agricultural Products: The vehicle is used only for transporting agricultural products, such as crops, machinery, supplies, or livestock used or produced in farming operations. The products, crops, or livestock must be unmanufactured or unprocessed.

In order to qualify for this individual vehicle discount, an Arizona Motor Carrier Reduced Rate Certificate must be completed and submitted with the IRP application. The vehicle qualification for this reduced rate continues from year to year until the vehicle is deleted from the fleet or the carrier requests removal of the reduced rate qualification due to a change of operation.

5.110 – UTAH REDUCED RATE FEES

The State of Utah allows a reduced rate of Utah commercial vehicle fees for power vehicles used exclusively for the following purposes:

- Pump Cement

- Bore Wells

- Perform Crane Services (with a lift capacity of at least 5 tons).

California will assess Utah fees at the reduced rate to qualifying vehicles when the Utah Reduced Fee Certification Form is submitted with renewal, original, or supplemental applications.

For each vehicle that qualifies for the reduced fee rate, list the equipment number, year model, make, and the last 6 digits of the Vehicle Identification Number (VIN). In the column headed “Qualified Vehicle Usage”, at the right of the form, indicates your use by placing an “x” under the applicable qualifying code (P = Pump Cement; B = Bore Wells; C = Perform Crane Services).

California will not be responsible for fee adjustments resulting from the applicant’s failure to complete and submit the reduced fee rate qualification form.

Chapter 4: New Carrier Registration Requirements

4.000 – NEW CARRIER APPLICATIONS

Below is a list of documents and requirements for original applications:

- California IRP Carrier Data – Schedule A/B, MC 2117 I.

- California IRP Vehicle Data – Schedule C, MC 2118 I.

- Established Place of Business-Documentation.

- Proof of Payment or Exemption of Federal Heavy Vehicle Use Tax (FHVUT).

- Agreement To Prepare And Maintain Records And Report Information In Accordance With International Registration Plan And California Apportionment Requirements, REG 522 I.

- Vehicle Identification Number (VIN) Verification, REG 31.

- Evidence of International Fuel Tax Registration (IFTA).

- U.S. Department of Transportation Number (USDOT Number) must be updated.

- Tax Payer Identification (TIN) Number – The TIN may be the Federal Employer Identification Number (FEIN) or the Social Security Number (SSN). The number provided on the IRP application must match the number submitted to FMCSA to obtain the USDOT.

- California Public Utilities Commission (PUC) Number – Required for buses, taxis, and limousines only.

- Vehicles within the application must be free of preexisting law enforcement violations or Vehicle License & Titling (VLT) Stops.

The below documents may also be required under the condition specified:

- Copy of lease agreement – If the registrant is a motor carrier lessee fleet registering vehicle(s) under a lease agreement with one or more owner-operators, a copy of the lease agreement is required for each leased vehicle registered in the fleet.

- Authorization for Registration Service Agent Representation (if applicable).

Refer to the appropriate section in this chapter for information regarding the forms and requirements listed on this page.

4.005 – DIRECT IMPORT VEHICLES/FOREIGN DOCUMENTS

A direct import vehicle is a vehicle that was imported and originally manufactured for use in other countries. A direct import vehicle must be proven to have been legally imported and to meet U.S. Safety and U.S. Environmental Protection Agency (EPA) and/or California emission standards before it may be registered.

Direct import vehicles that do not meet or cannot be converted to comply with U.S. Safety and U.S. EPA and/or California emissions standards cannot be registered for on-highway or off-highway use.

IRP application for registration of an imported vehicle must include the following items

- Evidence or documentation to prove the vehicle was imported legally and cleared U.S. Customs and Border Protection (CBP). CBP forms, 3299, 3311, 3461, 6059, or 7501, stamped or endorsed by CBP are acceptable. This does not apply to U.S. territories.

- Evidence that the vehicle was modified to meet Department of Transportation (DOT) Federal Motor Vehicle Safety Standards (FMVSS). Satisfactory evidence is one of the following:

- A FMVSS certification label affixed to the vehicle or,

- A letter from the manufacture certifying the vehicle meets FMVSS requirements.

- Evidence of compliance with U.S. EPA and/or California Emission Standards. Any of the following is acceptable:

- A U.S. EPA and/or California emission label affixed to the vehicle.

- A manufacturer’s letter stating the vehicle meets U.S. EPA requirements.

- A Certificate of Conformance from a California Air Resources Board authorized laboratory.

4.010 – CALIFORNIA IRP CARRIER DATA – SCHEDULE A/B (MC 2117 I)

The Schedule A/B is used to report carrier and mileage information. It is required when submitting an application for new carrier or fleet, renewal, or vehicle weight increase or decrease. The form must also be completed and submitted when there are any changes to the carrier name, business or mailing address, or any other pertinent information. Follow the instruction sheet when completing the form.

4.015 – CALIFORNIA IRP VEHICLE DATA – SCHEDULE C (MC 2118 I)

The Schedule C is used to report data needed by DMV and law enforcement to identify vehicles and their operating weights. Follow the instruction sheet when completing the form.

Purchase Price and Date

In accordance with California Revenue and Taxation Code (RTC) Section 10753, the reportable purchase price must reflect the cost price to the current owner. It includes the delivery charge, Federal Excise Tax, and value of any accessories (e.g., refrigeration unit, lift gate, etc.) added to the vehicle, any cash that changed hands, and trade-in and other considerations, but excludes license fees, interest or finance charges, and any sales or local tax.

Factory Price

The factory price of the vehicle is required for IRP fee computation. If the factory price is not provided in the application it will be retrieved from the Factory Price Table.

4.020 – ESTABLISHED RESIDENCE/SELECTION OF BASE JURISDICTION

An applicant must provide a copy of at least three documents showing a physical address (not a P.O. Box) in California to establish residency.

- If the applicant is an individual, they may provide a copy of their California driver license.

- If applicant is an individual, they may provide a copy of their California business license.

- If the applicant is a corporation or Limited Liability Company (LLC), they must provide a copy of the Articles of Incorporation or Articles of Organization.

- A computer printout, dated within the last year, from the California Secretary of State’s showing the “Status” as active and the “Jurisdiction” as California or showing the “Address” as a physical address in California (the “Agent for Service of Process” address is not acceptable).

- The first page (front and back) of the applicant’s Federal Income Tax return from last year.

- The first page (front and back) of the applicant’s California Resident Income Tax return from last year.

- The applicant’s current California real estate or personal property tax bill or a proof of payment statement from the tax agency.

- A current utility bill in the applicant’s name.

- A current California vehicle registration card in the applicant’s name.

- A lease or rental agreement for the business property with the signature of both the tenant and the landlord.

- A current mortgage statement for the business property.

- Other documents that clearly provide evidence of the applicant’s legal residence in California may be accepted, contact the IRP Operations Unit for additional information.

Note A cellular telephone bill is not acceptable as a California residency document.

4.025 – FEDERAL HEAVY VEHICLE USE TAX (FHVUT) (CVC SECTION 4750)

Commercial motor vehicles or buses that operate at 55,000 pounds or more combined gross vehicle weight (CGW) must have evidence of full payment of, or exemption from, the FHVUT before the vehicle can be registered. The FHVUT tax year is July 1 to June 30.

Applications for registration that are submitted in any month other than July, August, or September must include proof of payment documents for the current FHVUT tax year. Applications submitted in July, August, or September can provide proof of payment documents from the immediate previous FHVUT tax year.

Note The IRS requires taxpayers to e-file Schedule 1, Form 2290 when filing with 25 or more vehicles. A electronically watermarked Schedule 1, Form 2290 is returned to the taxpayer as proof of payment.

Acceptable Proof of Payment – Any of the following may be submitted as proof of FHVUT payment

- Original or photocopy of IRS receipted Schedule 1, Form 2290 electronically watermarked or manually stamped.

- Original or photocopy of Schedule 1, Form 2290, filed with the IRS and a photocopy of the front AND back of the canceled check for the entire FHVUT payment payable to the IRS.

The document(s) submitted and any watermark or stamp appearing on it must be legible.

Acceptable Proof of Exemption – An original or photocopy of an IRS receipted Schedule 1, Form 2290 (electronically watermarked or manually stamped), listing the vehicle as exempt.

Proof of Payment of FHVUT is Not Required – The following are the only acceptable situations where proof of payment of FHVUT is not required:

- When a vehicle is qualified for California and all qualified foreign IRP jurisdictions at a maximum operating weight of 54,999 pounds or less or,

- If an application for registration or transfer of a new or used vehicle is submitted in the new owner’s name within 60 days of the date of purchase or transfer or,

- If a vehicle has a valid alternative form of California registration which is being converted to IRP registration.

Any questions regarding specific tax regulations or completion of the Form 2290 should be directed to the IRS.

4.030 – AGREEMENT TO PREPARE AND MAINTAIN RECORDS AND REPORT INFORMATION IN ACCORDANCE WITH INTERNATIONAL REGISTRATION PLAN AND CALIFORNIA APPORTIONMENT REQUIREMENTS MC 522 I (CVC SECTION 8057; PLAN ARTICLE X)

All IRP applicants are required to read, understand, and adhere to the record keeping provisions of the Plan. The specific record keeping requirements are printed on this form. The form must be completed and signed by an authorized company official before California IRP operating authority is granted to the applicant. A registration service agent may not sign this form.

Failure to maintain records according to the provisions of the Plan and the CVC may result in the assessment of substantial fees and penalties.

4.035 – VEHICLE IDENTIFICATION NUMBER (VIN) VERIFICATION

A form of VIN verification is required for each power vehicle being registered IRP in California for the first time. One of the following documents must be submitted for VIN verification purposes:

- Vehicle Identification Number (REG 31) (PDF) form completed by a California DMV employee, regularly employed peace officer or California licensed vehicle verifier. For vehicles located out of state the REG 31 may be completed by a regularly employed peace officer or a California licensed vehicle verifier.

- A legible photocopy of the last issued vehicle ownership certificate (California Title).

- A copy of the last issued vehicle registration card if the vehicle has a paperless title, lien holder on record, or goldenrod registration (registration only) along with a Statement of Facts (REG 256) (PDF) explaining the reason why the title is not available.

- A California VIN record printout if the vehicle has a paperless title, lien holder on record, or goldenrod registration (registration only) along with a Statement of Facts (REG 256) (PDF) explaining the reason why the title is not available.

4.040 – MOTOR CARRIER LESSEE FLEET, LEASE AGREEMENT

California requires verification of a lease agreement between a lessor owner-operator and the lessee motor carrier when a vehicle is added to an IRP motor carrier lessee fleet. The lessor (owner-operator) will be required to provide their USDOT number on the Schedule C form.

Lessor Information

If the vehicle is leased to the IRP registrant by an owner/operator, the registrant must provide the owner/operators name and address.

4.045 – INTERNATIONAL FUEL TAX AGREEMENT (IFTA) NUMBER (CVC SECTION 8056)

If an IFTA account has been issued to the applicant, the account number must be reported on the Schedule A/B application form in the space labeled “IFTA Number”.If an IFTA account has been applied for but not yet issued, enter “applied for” in the IFTA number space on Schedule A/B. The IFTA account number must be reported to the DMV Headquarters IRP Section once it has been issued.

4.050 – PERFORMANCE AND REGISTRATION INFORMATION SYSTEMS MANAGEMENT (PRISM) (CVC SECTION 8100)

California requires the following information:

- USDOT Number – The US Department of Transportation (DOT) number must be reported on the Schedule A/B form in the space labeled “US DOT Number”.

- TIN – Provide the Tax Payer Identification (TIN) number on the Schedule A/B and C forms. The TIN may be the Federal Employer Identification Number (FEIN) or the Social Security Number (SSN). The number provided on the IRP forms must match the number submitted to FMCSA to obtain the USDOT.

- MCSA-1 Form (formerly MCS-150) – Registrant and Carrier USDOT information must be updated directly with the Federal Motor Carrier Safety Administration (FMCSA) on-line at: www.FMCSA.dot.gov.

4.055 – CALIFORNIA PUBLIC UTILITIES COMMISSION (CPUC) NUMBER

The CPUC is responsible for administering regulations affecting motor carriers transporting passengers and household goods. The CPUC certificate or permit number must be reported on the Schedule A/B application form for buses, taxis, and limousines.

4.060 – PREEXISTING VEHICLE VIOLATIONS OR STOPS

The vehicle registration record of every vehicle being added to a new or existing IRP fleet is checked for any preexisting violation(s) and/or stop(s). Vehicles that are found to have preexisting violations and/or stops may not be issued operating authority unless, and until, the preexisting violation(s) or stop(s) have been satisfactorily cleared.

Parking Citations:

A vehicle with a parking citation cannot be added to a fleet unless the parking citation bail is paid with the IRP application or the applicant presents a “Notice of Disposition of Parking Violation” (REG 194R) issued by the court or parking agency of jurisdiction for the vehicle being added.

The Department may appropriate the violation bail amount from the fees deposited with the IRP application in order to discharge the outstanding violations.

Owner’s Responsibility Citations (CVC Section 4766)

An owner’s responsibility citation can only be cleared from the vehicle record when an “Abstract of Court Release Adjudication” (Form DL106R) issued by the court of adjudication is submitted to the department. There is a $7 service fee for each citation removed from the vehicle record.

4.065 – IRP AUDIT FEE LIEN PERFECTION

Per CVC Section 8201, fees determined to be due, constitutes a lien upon all vehicles operated as part of the fleet and on any other fleet vehicles operated by the registrant.

The department will withhold the issuance of IRP indicia or temporary operating authority when there are outstanding audit fees due, and 30 days have elapsed since the department mailed a notice of lien to the registrant and no response has been received.

4.070 – CONTINUOUS REGISTRATION REQUIREMENT

California requires IRP registrants to maintain “continuous registration”. “Continuous registration” means having no lapses of registration months when renewing existing California IRP registration or when an applicant changes their base IRP jurisdiction from a foreign IRP Member Jurisdiction to California.

4.075 – FAILURE TO SUBMIT DOCUMENTS WITH COMPLETED INFORMATION

All documents required to be submitted with IRP registration applications are mandated by California statute or the Plan. IRP license plates, stickers, or cab cards will not be issued until all required documentation and fees have been submitted.

Chapter 3: Fleet Distance and Vehicle Weight Requirements

3.000 – INTRODUCTION

This chapter details the requirements for determining fleet distance and qualified vehicle weights.

The reported fleet distance, shown on the California IRP Carrier Data Schedule A/B (MC 2117 I), is used to determine the distance percentages used to calculate the fees due in each Member Jurisdiction the apportioned vehicle is operated. Fees for individual vehicles are determined based on the vehicle’s operating weight as declared by the applicant and reported on the California IRP Vehicle Data Schedule C (MC 2118 I).

3.005 – REPORTING FLEET DISTANCE

Fleet distance for fleets that have interstate travel history is always determined based on the historical distance generated by the power unit(s) that were part of the interstate fleet during the distance reporting period of a the fiscal year preceding the current registration year. Distances generated under trip permits must be reported as actual miles.

All vehicle distance (intrastate and interstate, loaded and empty, deadhead and bobtail, or trip permit) must be reported. Reportable distances include all off –highway distance and any distance generated by apportioned units leased to other carriers and individuals.

3.010 – FLEETS WITH AN ESTABLISHED TRAVEL HISTORY

Original applications for fleets with an established pattern of interstate operation shall report the actual distance traveled in each jurisdiction for the distance reporting period (July 1 through June 30) with respect to the vehicles registered, or the fleet, as appropriate.

Examples requiring the use of actual distance include:

- IRP fleets previously based in another IRP Member Jurisdiction that have moved their IRP base registration to California.

- A first-time apportioned carrier with interstate experience based on trip permits or dual intrastate registration.

- Vehicle moved from one fleet to another fleet.

- Fleets are combined.

Note When distance history is available for use, disclose the reason and basis for the distance data used on the Schedule A/B.

3.015 – FLEETS WITH NO ESTABLISHED TRAVEL HISTORY

Fleet distance for original applications with no established pattern of interstate travel will be determined, by the IRP Operations Unit, using the Average Per – Vehicle Distance (APVD) Chart. When using the APVD, the distance shown for each jurisdiction will be multiplied by the total number of vehicles to determine the correct distance for the fleet.

3.020 – CONTIGUOUS DISTANCE

All reported actual distance must, with rare exception, reflect contiguous travel. Registrants that have legitimate non-contiguous operations must submit a Statement of Facts explaining the nature of the non-contiguous travel.

3.025 – CALIFORNIA DECLARED JURISDICTIONAL WEIGHTS

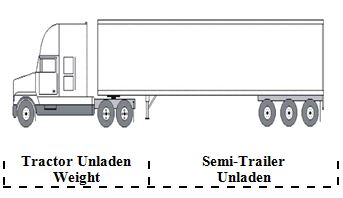

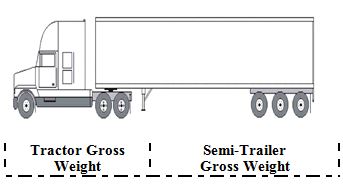

California has two separate weight fee structures – Unladen and Gross Vehicle Weight (GVW/CGW).

Vehicles that will operate singly or in combination with trailers at 10,000 pounds or less are assessed unladen weight fees. For vehicles to be registered in this category, enter the unladen weight on Schedule C or the renewal “Jurisdictional GVW or CGW Corrections Page” and show “U” as the California weight indicator. Vehicles so registered will indicate California maximum weight of 10,000 lbs. in the jurisdictional weight grid on the cab card.

Vehicles that will operate singly without trailers at 10,001 pounds or more are assessed gross vehicle weight fees. For vehicles to be registered in this category, enter the maximum gross vehicle operating weight on Schedule C or the renewal “Jurisdictional GVW Corrections Page and show “G” as the California weight indicator. Vehicles so registered will indicate the declared gross weight in the jurisdictional weight grid on the cab card.

Vehicles that will operate in combination with trailers at 10,001 CGW or more are assessed gross vehicle weight fees. For vehicles to be registered in this category, enter the maximum combined gross vehicle operating weight on Schedule C or the renewal “Jurisdictional CGW Corrections Page” and show “C” as the California weight indicator. Vehicles so registered will indicate the declared combined gross weight in the jurisdictional weight grid on the cab card.

Weight decals and a year sticker are required to be displayed on each commercial vehicle subject to weight fees pursuant to CVC Section 9400.1. For original and supplement IRP applications, each will receive a pair of weight decals and a year sticker for each vehicle. For each renewal application, each commercial vehicle will receive a pair of weight decals and current year sticker to place on existing weight decals. The weight decals reflect the top of the weight range (in thousands from 10,001 to 80,000 lbs.) of the declared gross weight or gross combined operating weight reported to the department.

3.030 – FOREIGN JURISDICTIONS DECLARED JURISDICTIONAL WEIGHTS

All IRP Member Jurisdictions assess registration fees to power vehicles based upon the declared gross vehicle weight (GVW) or combined gross vehicle weight (CGW) of the vehicle operated singly or in combination with any and all trailers pulled. Many jurisdictions assess registration fees to buses based on the number of seats, including the driver’s seat.

IRP registrants must declare the GVW or CGW that each power unit will operate in each jurisdiction. A weight decal will be required for each power unit.

The weight declared will be used to calculate jurisdictional fees due and will be the basis for vehicle weight enforcement in each IRP jurisdiction. Vehicles operated in excess of the declared gross vehicle weight as shown on the cab card are subject to violation and citation in the IRP jurisdiction(s) where the declared weight is exceeded.

If the Schedule C box indicating “Maximum weight all jurisdictions” is marked, the cab cards for the power unit(s) will be issued indicating 80,000 lbs. GVW or CGW in all jurisdictions except Alberta, Canada (90,000 lbs.).

Weights higher than 80,000 lbs. may be entered on a Schedule C , but if the weight requested is higher than a jurisdiction’s statutory maximum operating weight, only the highest allowable weight is printed on the cab card.

Many jurisdictions allow for the operation of vehicles over the maximum weight, but additional requirements may need to be met for overweight permits. You must check with each jurisdiction individually for their overweight permit requirements. Addresses and telephone numbers for all IRP jurisdictions are available on the IRP, Inc. website at irponline.org.

Vehicles qualifying at differing weights must be entered on the reverse of the Schedule C. Failure to properly indicate weight information on Schedule C (MC 2118 I) will result in qualification at the maximum weight in each qualified IRP jurisdiction.

California will not refund foreign jurisdiction weight fees under any circumstances.

3.035 – INDIVIDUAL VEHICLE WEIGHT INCREASES

If one or more vehicles within the fleet require operation in California or any other qualified IRP jurisdiction at a weight greater than originally registered, the registrant may file for a weight increase by submitting a Schedule C with the “Vehicle Weight Increase/Decrease” box marked.

California and foreign jurisdiction fees for each affected vehicle will be assessed based on the difference between the original registered lower weight and the increased weight indicated on the Schedule C.

3.040 – INDIVIDUAL VEHICLE WEIGHT DECREASES

If one or more vehicles within the fleet require operation in California or any other IRP jurisdiction at a lesser weight than originally reported, the registrant is required to file for a weight decrease by submitting a Schedule C with the “Vehicle Weight Increase/Decrease” box marked. The cab card for each power unit requiring the weight decrease must be surrendered to the department at the time of the request.

Refunds for fees paid at the previously reported higher weight will not be issued.

3.045 – CALIFORNIA CVRA WEIGHT AND WEIGHT DECAL INFORMATION

| Gross Vehicle Weight Range | Weight Decal |

|---|---|

| Gross Vehicle Weight Range10,001 – 15,000 | Weight Decal15 |

| Gross Vehicle Weight Range15,001 – 20,000 | Weight Decal20 |

| Gross Vehicle Weight Range20,001 – 26,000 | Weight Decal26 |

| Gross Vehicle Weight Range26,001 – 30,000 | Weight Decal30 |

| Gross Vehicle Weight Range30,001 – 35,000 | Weight Decal35 |

| Gross Vehicle Weight Range35,001 – 40,000 | Weight Decal40 |

| Gross Vehicle Weight Range40,001 – 45,000 | Weight Decal45 |

| Gross Vehicle Weight Range45,001 – 50,000 | Weight Decal50 |

| Gross Vehicle Weight Range50,001 – 54,999* | Weight Decal54* |

| Gross Vehicle Weight Range55,000 – 60,000 | Weight Decal60 |

| Gross Vehicle Weight Range60,001 – 65,000 | Weight Decal65 |

| Gross Vehicle Weight Range65,001 – 70,000 | Weight Decal70 |

| Gross Vehicle Weight Range70,001 – 75,000 | Weight Decal75 |

| Gross Vehicle Weight Range75,001 – 80,000 | Weight Decal80 |

Note The weight decal will reflect the top of the weight range (in thousands) of the declared gross weight or gross combined operating weight reported to the department at the time of registration or when a weight change is reported.

*Decals showing “54” are valid for a vehicle operating up to 54,999 GVW/CGW.

3.050 – WEIGHT VARIANCE REQUIREMENT (PLAN SECTION 325)

The registered weight of a fleet vehicle shall not vary more than ten percent (10%) from the highest to the lowest weight.

Note Exception to the 10% variance rule requires supporting evidence (Statement of Facts (PDF)), stating the actual condition that causes the maximum operating weight to vary by more than 10%.

Chapter 2: IRP Provisions

2.000 – INTRODUCTION

This chapter clarifies those sections of the official Plan that define the most basic IRP registrant qualification requirements and/or registration options. Much of the content of the remainder of this handbook is also based on the requirements of the Plan and the California Vehicle Code (CVC) and, where that is true, the applicable section(s) of the Plan and/or CVC is cited.

2.005 – IRP MEMBER JURISDICTIONS

The following states and Canadian provinces are the Member Jurisdictions that participate in IRP:

| Member Jurisdictions | ||

|---|---|---|

| Member JurisdictionsAlabama (AL) Alberta (AB) Arizona (AZ) Arkansas (AR) British Columbia (BC) California (CA) Colorado (CO) Connecticut (CT) Delaware (DE) Dist. of Columbia (DC) Florida (FL) Georgia (GA) Idaho (ID) Illinois (IL) Indiana (IN) Iowa (IA) Kansas (KS) Kentucky (KY) Louisiana (LA) Maine (ME) | Manitoba (MB) Maryland (MD) Massachusetts (MA) Michigan (MI) Minnesota (MN) Mississippi (MS) Missouri (MO) Montana (MT) Nebraska (NE) Nevada (NV) New Brunswick (NB) New Hampshire (NH) New Jersey (NJ) New Mexico (NM) New York (NY) Newfoundland (NF) North Carolina (NC) North Dakota (ND) Nova Scotia (NS) Ohio (OH) | Oklahoma (OK) Ontario (ON) Oregon (OR) Pennsylvania (PA) Prince Edward Island (PE) Quebec (QC) Rhode Island (RI) Saskatchewan (SK) South Carolina (SC) South Dakota (SD) Tennessee (TN) Texas (TX) Utah (UT) Vermont (VT) Virginia (VA) Washington (WA) West Virginia (WV) Wisconsin (WI) Wyoming (WY) |

2.010 – REQUIREMENTS TO QUALIFY FOR IRP REGISTRATION

Commercial vehicle operators must meet the following requirements to qualify for IRP registration:

- Operate one or more commercial vehicles in two or more Member Jurisdictions.

- Have an established place of business in a Member Jurisdiction

2.015 – ESTABLISHED PLACE OF BUSINESS

(PLAN ARTICLE II)

- “Established Place of Business” means a physical structure located within the base jurisdiction that is:

- Owned or leased by the applicant or registrant and whose street address shall be specified by the applicant or registrant.

- The physical structure shall be open for business and shall be staffed during regular business hours by one or more persons employed by the applicant or registrant on a permanent basis (i.e., not an independent contractor) for the purpose of the general management of the applicant’s or registrant’s trucking-related business (i.e., not limited to credentialing distance, fuel reporting, and answering telephone inquiries).

- The applicant or registrant need not have land line telephone service at the physical structure.

- Operational records concerning the fleet shall be maintained at this physical structure (unless such records are to be made available in accordance with the provisions of the Plan, Section 1035).

- The base jurisdiction may accept information it deems pertinent to verify that an applicant or registrant has an established place of business within the base jurisdiction.

2.020 – LEASE/LESSEE/LESSOR

(PLAN ARTICLE II)

“Lease” means a transaction evidenced by a written document in which a lessor vests exclusive possession, control, and responsibility for the operation of a vehicle in a lessee for a specific term. A long-term lease is a period of 30 calendar days or more. A short-term lease is for a period of less than 30 calendar days.

“Lessee” means a person that is authorized to have exclusive possession and control of a vehicle owned by another under terms of a lease agreement.

“Lessor” means a person that, under the terms of a lease agreement, authorizes another person to have exclusive possession, control of, and responsibility for the operation of a vehicle.

Note Original and vehicle addition supplements submitted for “Lessee Motor Carrier Fleets” must include a copy of the “lease agreement” for each vehicle listed on the application.

2.025 – CREDENTIALS FOR APPORTIONED REGISTRATION

(PLAN SECTION 600; CVC SECTION(S) 4850, 4850.5, and 4851)

Apportioned registration credentials will not be issued until the registrant has paid all apportionable fees due or past due.

Upon the registration of an apportionable vehicle under the Plan, the registrant will be issued the following registration credentials and indicia for the vehicle:

- A cab card,

- One or two reflectorized license plate(s) depending on the vehicle’s body type model. The plate(s) shall be identified by having the abbreviation “Cal”, the word “apportioned”, and the assigned registration number,

- A month and registration expiration year sticker,

- Two weight decals indicating the gross vehicle weight or combined gross vehicle weight for vehicles operated at 10,001 pounds or more.

2.030 – DISPLAY OF APPORTIONED REGISTRATION CREDENTIALS

(PLAN SECTION 605; CVC SECTION(S) 4850.5, 4851, and 9400.1)

- The cab card must be carried in the vehicle for which it is issued and be readily available for inspection by law enforcement.

- When one license plate is issued it shall be attached to the front of the vehicle. When two license plates are issued one shall be attached to the front and the rear of the vehicle.

- Weight decals are to be displayed on both the right and left side of the vehicle for which they were issued.

- Except as provided in subsection (e), when renewal credentials are received prior to the commencement of the registration period for which they are issued, both the cab card for the prior registration period and the cab card for the new renewal period shall be carried in the vehicle until the new registration period begins.

- Apportioned vehicles moved from another base jurisdiction to California as its base jurisdiction near the end of the registration year must carry the previously-issued cab card in the vehicle until the new registration year begins, but display the California credentials as soon as they are issued.

2.035 – CONTENTS OF THE CAB CARD

(PLAN SECTION 610)

The cab card lists all Member Jurisdictions, the weight (in pounds or kilograms), number of combined axles, or the number of bus seats for which it is registered in each and other information including:

- The date the vehicle was registered, the date of issuance of the cab card, or the effective date of the registration,

- The expiration date of the cab card (and the enforcement date, if a grace period applies),

- The model year and make,

- The vehicle identification number,

- The assigned license plate number,

- The equipment number,

- The registrant’s name and address, and

- The account number assigned to the fleet by the base jurisdiction.

2.040 – HOUSEHOLD GOODS CARRIER

Equipment Leased From Service Representative

(Plan Section 700)

A household goods carrier using an apportionable vehicle leased from a service representative may elect that the base jurisdiction for such vehicle be either that of the service representative or that of the household goods carrier.

Registration in Base of Service Representative

(Plan Section 705)

When a household goods carrier elects, as outlined in the Plan Section 700, to base an apportionable vehicle in the base jurisdiction of a service representative, with the name of the household good carrier shown as the lessee, and the fees for the vehicle shall be apportioned according to the combined records of the service representative and the household goods carrier. All of the records pertaining to the vehicle shall be available in the base jurisdiction of the service representative.

A vehicle registered under this section shall be deemed fully registered for operations under the authority of the service representative as well as that of the household goods carrier.

Registration in Base Jurisdiction of Carrier

(Plan Section 710)

When a household goods carrier elects, as outlined in the Plan Section 700, to base an apportionable vehicle in the base jurisdiction of a household goods carrier, the vehicle shall be registered in the name of the household goods carrier as well as the name of the service representative, as lessor, and the fees for the vehicle shall be apportioned according to the combined records of the household goods carrier and the service representative. Such records shall be made available in the base jurisdiction of the Household Goods Carrier.

A vehicle registered under this section shall be deemed fully registered for operations under the authority of the service representative as well as that of the household goods carrier.

2.045 – MOTOR BUS APPORTIONMENT

Application Filing (Plan Section 800)

The application of a passenger carrier for apportioned registration shall designate which, if any, of its vehicles are assigned to a “pool”.

Determination of Distance (Plan Section 805)

The apportionable fees of a fleet that is involved in a pool may be calculated using apportionment percentages or, in the alternative, at the option of the applicant, the apportionment percentage may be calculated by dividing;

- The scheduled route distance operated in the Member Jurisdiction by the vehicles in the pool by;

- The sum of the scheduled route distances operated in all the Member Jurisdictions by the vehicles in the pool.

Scheduled route distances shall be determined from the farthest point of origination to the farthest point of destination covered by the pool.

If a registrant has used this method to register its fleet initially for a registration year, it shall also use this same method to register any apportionable vehicles it may add to its fleet during the year.

2.050 – Rental Passenger Vehicle Fleets

Base Jurisdiction for Rental Fleet (Plan Section 900)

A rental company applying to register a rental fleet under the Plan shall select a base jurisdiction for the fleet according to Section 305 of the Plan; except that when the term of the lease of the vehicles in the fleet is greater than 60 days, the lessee must:

- Have an established place of business in the base jurisdiction selected, and

- The fleet must accrue distance in the base jurisdiction selected.

Rental Passenger Cars (Plan Section 905)

Rental passenger car registrations may be allocated based on revenue earned in each jurisdiction. Properly allocated rental passenger cars may be rented in any Member Jurisdiction. To determine the percentage of total rental fleet vehicles to be registered in a jurisdiction:

- Divide the gross revenue earned in a jurisdiction in the preceding year for the use of all rental passenger cars by the gross rental revenue earned in all jurisdictions, and

- Multiply the number of vehicles in the rental fleet by the percentage determined in clause (1).

For the purposed of this section, gross rental revenue is earned in a jurisdiction when the vehicle rented first comes into the possession of the lessee in that jurisdiction.

One-Way Vehicle (Plan Section 915)