8.025 “In Lieu of” Report of Sale-Used Vehicle

When a completed REG 51 is lost before being submitted to DMV, submit the following with the other application requirements:

- A new REG 51 which indicates “In lieu of report of sale number________.”

- All information must be completed as shown on the original REG 51.

- A Power of Attorney may be used to sign the “in-lieu of” REG 51.

- The purchaser’s operating copy of the “in-lieu of” REG 51.

- A Statement of Facts (REG 256) (PDF) form explaining the reason for the second REG 51.

8.020 Distribution of the Report of Sale-Used Vehicle (REG 51) (VC §§4456 and 5901)

- Use the following for distribution of the REG 51.

- Application copy (upper portion of the original).

- Within 30 days of the date of sale, submit the application copy to DMV with the fees and documents required to transfer the vehicle.

Exceptions: Deliver the application copy and all transfer documents to the buyer instead of DMV for the following situations:

- Buyer demands Certificate of Title (see Section 8.055).

- Public agency sales (see Section 8.070).

- Sales to Consul Corps employees (see Section 8.060).

- Mail order sales (see Section 8.080).

Purchaser’s temporary identification copy (bottom portion of the original)

For customer privacy, fold the purchaser’s copy so that only the upper portion with the report of sale number, vehicle make, and vehicle identification number show and place it in the lower rear window.

- If the information will be obscured, place it in the lower right corner of either the windshield or a side window.

- For trailers, display in the same manner in the towing vehicle.

This authorizes operation of the vehicle until the buyer receives the license plates and registration card.

Exceptions: Do not attach the purchaser’s copy to the vehicle on:

Vehicles to be altered before registration (see Section 6.025, New Vehicles Sold by California Dealers).

- Used Vehicles Sold for Registration in Another State (see Section 8.050).

- Used Vehicle Sold for Use on Private Property (see Section 8.035).

- Used Vehicle Sold for Export to Another Country (see Section 8.040).

- Title Only and Transfer Only sales (see Chapter 11).

- Reporting Used Vehicle Sales to IRP Operators (see Section 8.075).

Dealer’s notice (bottom portion of the replacement)

No later than the fifth calendar day following the sale date, not counting the actual date of the sale, mail the dealer’s notice to the DMV address shown on the REG 51.

- This releases the dealer from civil liability arising from operation of the vehicle.

- The dealer’s notice cannot be submitted to a field office.

Dealer’s book copy (upper part of the replacement)

- Retain the dealer’s copy for four years (this corresponds to DMV’s retention period).

- The books are the property of DMV and may be inspected at any time (VC §§4456, 5901, and 11714e).

8.015 Corrections on the Report of Sale-Used Vehicle (REG 51)

Odometer Disclosure Errors

Corrections are acceptable on any part of the Report of Sale–Used Vehicle (REG 51) form. The REG 51 is not used to report sales to wholesale except the odometer disclosure section.

The dealer or the dealer’s authorized representative who signed the dealer certification must “OK” and initial the correction.

When an error is made in the odometer disclosure section a:

- Vehicle/Vessel Transfer and Reassignment Form (REG 262) form must be used for the odometer disclosure

AND

- Statement of Facts (REG 256) (PDF) form explaining the reason for the separate disclosure must be submitted with the application.

Refer to Chapter 5, Odometer Mileage Reporting for odometer disclosure information.

Registered and/or Legal owner changes

If the financing is rejected on the first contract, but is successful on the second contract, and there is no change to the registered owner(s), the vehicle can be sold with corrections on the title and the REG 51.

If the contract must be rewritten to accommodate any changes to the original registered owner(s), or there is a new purchaser, the used vehicle rollback procedures in Chapter 11, Transfers must be followed.

8.010 Completing the Report of Sale-Used Vehicle (REG 51)/Digital Signature Acceptance Program (DSAP)

A licensed California dealer must complete the REG 51 for every retail sale.

- For most transactions, the REG 51 must be submitted with the required registration documents and fees.

- Transactions not requiring the submission with the documents and fees are covered later in this chapter.

A dealer is not required to complete a report of sale to:

- Register a used vehicle solely in the name of the dealership

- Sell midget autos or racers advertised as being built exclusively for use by children (minibikes, tote goats, and similar vehicles which are not intended for use on the highways).

- The vehicle description and purchaser information must be clearly and accurately shown on all parts of the REG 51.

- Both the temporary identification and the notice to DMV must properly describe the vehicle.

- The REG 51 must be used in numerical sequence.

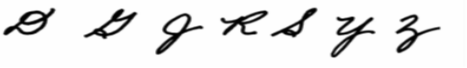

The information on the REG 51 may be typewritten, computer-generated, or hand printed. If hand-printed, DMV prefers that only block upper case letters are used except for the following letters which should be handwritten in script or cursive to avoid confusion/error.

Follow the chart below to complete the REG 51.

| Section | Information Required |

|---|---|

| SectionDate Sold | Information RequiredThe date the buyer paid the purchase price, signed a purchase contract or security agreement, and took possession or delivery of the vehicle. (VC §5901(d)) |

| SectionMake | Information RequiredThe make of the vehicle, not the model. |

| SectionYear Model | Information RequiredThe year model shown on the titling document. If the titling document does not show a year model, leave this blank. |

| SectionBody Type | Information RequiredThe body type. If the body type shown on the title is incorrect, a correction must be made. See Chapter 30, Inquiries for body types. |

| SectionMotive Power | Information RequiredThe motive power (must be shown for all vehicles). The fuel types are: G-Gasoline D-Diesel E-Electric M-Methanol N-Natural Gas P-Propane Q-Hybrid For all trailers, use motive power code “0” (zero) Important Hybrid vehicles are powered by gas and electricity and are exempt from smog certification by the Bureau of Automotive Repair (BAR) until 12/31/2010. |

| SectionNumber of Axles | Information RequiredThe number of axles shown on the title for a commercial motor vehicle or trailer only. Do not enter any information for trailer coach (CCH) or camp (CMP) trailers. |

| SectionUnladen (empty) Weight | Information RequiredThe unladen weight shown on the title for a commercial motor vehicle or trailer only. Do not enter any information for trailer coach (CCH) or camp (CMP) trailers. |

| SectionVehicle Identification Number (VIN) | Information RequiredThe complete VIN shown on the title. |

| SectionM/C Engine Number | Information RequiredIf the vehicle is a motorcycle, the complete engine number shown on the title. |

| SectionLast Registered in State of | Information RequiredThe state, province, territory, or country where the vehicle was last registered. |

| SectionYear Registered | Information RequiredThe year the vehicle was last registered. |

| SectionLicense Plate Number | Information RequiredThe license plate number for the last registration. |

| SectionCounty of Residence | Information RequiredThe buyer’s county of residence. This may differ from the county of the mailing address. For leased vehicles, show the county of the lessee’s address. For trailers coaches that will be located in a different county, show the county of the situs location. |

| SectionSold To | Information RequiredThe true full name of each buyer (the name shown on the buyer’s driver license or ID card). Check the “AND” or “OR” box if there is more than one buyer/owner. Refer to section 1.050 for Registration to Co-Owners information. Leased Vehicles: The name of the lessor followed by the abbreviation “LSR” and the name(s) of the lessee followed by the abbreviation “LSE”. Do not join the names with “and” or “or”. Refer to Section 1.040 for Registration of Leased Vehicles information. Example: Jay Street Leasing, LSR John Doe, LSE See Chapter 1, General Registration Information for additional NAME information. |

| SectionDriver License/Identification Card (DL/ID) Number | Information RequiredThe DL/ID number for each buyer or lessee (if an individual). If a California DL/ID has not been issued, enter the person’s out-of-state DL/ID number and write the state of issuance in the upper right corner of the REG 51. Note A DL/ID number is not required for vehicles registered to an entity other than an individual, such as a company. |

| SectionBuyer’s Address | Information RequiredThe buyer’s residence or business address and mailing address (if different), including an apartment or space number if it is part of the address. When a post office box is the residence or business address, but is not the mailing address, then both addresses must be shown. The post office delivers mail to the second address. Note Mailing Address Only on Registration Documents-The buyer/registered owner may request that the registration and title documents issued DMV show only their mailing address. Refer to Chapter 1, General Registration Information for all address requirements. |

| SectionDealer Name, By, and Address | Information RequiredThe dealer name, an authorized agent’s signature, and dealer’s full address. An authorized representative must countersign for the dealership (This may be any authorized person of the dealership, not necessarily the salesperson). |

| SectionDealer and Salesperson Numbers | Information RequiredThe dealer’s license number and the salesperson’s number. If the vehicle was sold by an owner or officer of the dealership, enter the title, such as “Owner” or “CEO” as the Salesperson’s Number. |

| SectionSignature(s) of Purchaser | Information RequiredThe buyer’s usual signature or the buyer’s signature signed by the attorney-in-fact shown on a power of attorney must appear. Refer to Chapter 1, General Registration Information for power of attorney information. Note Only one co-owner signature is required on the REG 51. Leased Vehicles-The lessor is the registered owner and must endorse/sign the REG 51. The lessee’s signature is optional. |

| SectionOdometer Reading | Information RequiredThe actual odometer mileage reading. |

Digital Signature Acceptance Program (DSAP)

(Government Code §16.5, Vehicle Code §§1801, 1801.1, and 23300)

DMV has established a DSAP for the acceptance of digital signatures. This allows First Line Service Providers (FLSPs) to submit approved documents electronically with digital signatures and authentication.

Note Although electronic and digital signatures are both used to sign documents, they are not legally the same and each has unique features.

An electronic signature:

- Refers to any signature that is applied electronically to a document as opposed to physically (also known as a “wet” signature).

- May be used to confirm information and content within a document.

- May include a digitized image of a handwritten signature or name typed into a signature block on a form or document. Examples:

Jonathan Jones

Jonathan Jones

A digital signature:

- Uses cryptography to bind a digital certification and date signed into a unique signature, with security features making it difficult to replicate or alter. This is accomplished using a trusted third party who is responsible for verifying and authenticating the signer’s identity according to standards set by the California Secretary of State and federal regulations, including Government Code §16.5.

- Has a format that may be in cursive or printed text. Examples:

e-signed 08/28/2022 8:40 AM MI 123-4567 or

Jonathan Jones e-signed 08/28/2022 8:40 AM MI 123-4567

A majority of DMV forms may be submitted with an electronic signature, with the following exceptions:

- Any original printed form that releases or transfers interest in a vehicle or vessel

(for example, reports of sale must have physical “wet” signatures) - The following original titling documents, which must be submitted to DMV to finalize the transactions (transactions may be initiated using a copy of the form):

- California Certificate of Title (REG 17.30)

- Certificate of Ownership Vessel (REG 17.31)

- California Salvage Certificate (REG 489)

- Nonrepairable Vehicle Certificate (REG 490)

- Forms that are authorized to be reproduced electronically, including forms that transfer ownership such as the Vehicle/Vessel Transfer Reassignment Form (REG 262), may be signed electronically or digitally in the buyer’s and seller’s sections, but the power of attorney section must be digitally signed. Signature authority for odometer statements may be conveyed through power of attorney.

- Electronic forms with odometer disclosure statements must have digital signatures in accordance with federal regulation.

- Forms that require a Notary Public must be notarized in accordance with the following:

- Notarizations may be done electronically, however, the notary’s signature must be a digitized version of their genuine signature. A signature is one that is not keyed or produced from an available computer font but is in the likeness of the signatory’s actual signature such as a digitized impression. The signatures of the signers witnessed by the notary can be electronic or digital. Examples of forms requiring notarized signatures include:

- Application for Replacement or Transfer of Title (REG 227), Section 5.

- Lien Satisfied/Legal Owner/Title Holder Released (REG 166).

- Registered Owner Notarized Certification (REG 5065).

- Notarizations may be done electronically, however, the notary’s signature must be a digitized version of their genuine signature. A signature is one that is not keyed or produced from an available computer font but is in the likeness of the signatory’s actual signature such as a digitized impression. The signatures of the signers witnessed by the notary can be electronic or digital. Examples of forms requiring notarized signatures include:

The forms listed below may be submitted electronically using a digital signature. Physical reproductions of digitally signed forms are acceptable for processing. All forms with digital signatures must also be submitted through an FLSP participating in the DSAP, which documents the required digital signature certification.

- Bill of Sale (REG 135)

- Unobtainable Title Certification for Issuance of Salvage/Nonrepairable Certificate (REG 492)

- Vehicle/Vessel Transfer Reassignment Form (REG 262)

- Additionally, the following Report of Sale forms may be submitted by FLSPs with digital signatures through the Electronic Report of Sale/Temporary License Plate (eROS/TLP) Programs:

- Application for Registration of Multiple New Vehicles (REG 397A). The digital signature is required at the bottom of page 1, beneath the list of vehicles.

- Application for Registration of New Vehicle (REG 397)

- Report of Sale – Used Vehicle (REG 51)

- Vehicle Auction Wholesale Report of Sale (REG 398)

- Wholesale Report of Sale (REG 396)

8.005 Collection of California Sales Tax

- California licensed dealers must collect the sales tax due on vehicles sold by the dealership.

- Completion and submission of the REG 51 on a registration application is an assumption that the tax was collected.

Note Sales tax is due if the buyer takes delivery of the vehicle in California. Contact the California Department of Tax and Fee Administration at 1-800-400-7115 for additional information.

- Refer to the “City and County Fees”, Appendix 1A, for sales tax rates.

8.000 General Information

California licensed dealers must report the retail sale of all used vehicles on the Report of Sale–Used Vehicle (REG 51) form. The REG 51 is not used to report sales to wholesale dealers nor sales of vessels.

The REG 51 is a controlled form and can only be obtained from the DMV Occupational Licensing Section.

Orders for additional forms are only accepted by mail on a Used Report of Sale, REG 51, Order Form (OL 395U) form. This form is available online at www.dmv.ca.gov and must be mailed to the address on the form.

Chapter 8: Report of Sale – Used Vehicles

8.005 Collection of California Sales Tax

8.010 Completing the Report of Sale-Used Vehicle (REG 51)

8.015 Corrections on the Report of Sale-Used Vehicle (REG 51)

8.020 Distribution of the Report of Sale-Used Vehicle (REG 51)

8.025 “In Lieu of” Report of Sale-Used Vehicle

8.035 Used Vehicle Sold for Use on Private Property

8.040 Used Vehicle Sold for Export to Another Country

8.045 Vehicle Being Exported by Dealer

8.050 Used Vehicle Sold for Registration in Another State

8.055 Buyer Demands the Certificate of Title

8.065 Sales to Honorary Consuls

8.075 Reporting Used Vehicle Sales to IRP Operators

7.100 Kit Vehicles

A kit vehicle is a vehicle that is built for private use, not for resale, and is not constructed by a licensed manufacturer or remanufacturer.

- Kit vehicles are often replicas of well-known and expensive classics but can also be commercial vehicles and trailers.

- A kit vehicle is registered by the kit manufacturer’s VIN (they are exempt from the federal 17-digit VIN requirement) and does not have a model year. The make abbreviation is the kit make followed by the abbreviation KT.

- All kit motor vehicles and kit trailers weighing 6,001 pounds or more unladen, and vehicles having more than one VIN must be referred to the California Highway Patrol (CHP) for a VIN verification or assignment.

- A “CAL” number is assigned by DMV to trailers with an unladen weight of 6,000 pounds or less, unless the original unaltered VIN remains on the frame.

Commercial Vehicles Assembled from Kits (VC §580)

Manufacturers of large commercial vehicles sell kits which can be made into complete vehicles.

- These kits usually consist of a frame, steering gear, cab (complete with wiring and instruments), radiator, hood, front fenders, and in most cases, the front axle and wheels.

- The installation of an engine, transmission, rear axles, wheel, and tires makes the kit a complete vehicle.

- The installed components may have been purchased separately in new or used condition or removed from a vehicle which is no longer serviceable.

- Installation into the kit may have been done at an assembly plant, a truck repair shop, or by an individual.

Commercial Vehicle Kit Make Abbreviations

Use the following chart to make abbreviations for commercial kit vehicles:

| Make | Abbreviation |

|---|---|

| MakeAutocar | AbbreviationAUTKT |

| MakeDiamond | AbbreviationDMDKT |

| MakeInternational | AbbreviationINTKT |

| MakeKenworth | AbbreviationKENKT |

| MakeMack | AbbreviationMCKKT |

| MakePeterbilt | AbbreviationPETKT |

| MakeWhite | AbbreviationWHIKT |

| MakeWhite Freightliner | AbbreviationWFTKT |

Registration Requirements

- Completed Application for Title or Registration (REG 343) (PDF).

- The REG 343 must include the labor cost, even if provided or done by the applicant.

- Vehicle Verification (REG 31 (PDF)/REG 343 (PDF)), only if the application is for a trailer and the original trailer VIN is on the frame; or the completed REG 124 from CHP or DMV, if the vehicle is other than a trailer.

- Do not show a year model for kit vehicles.

- The Manufacturer’s Certificate of Origin or a receipt or invoice identifying the vehicle.

- The invoice or receipt from the seller may be used in lieu of signatures on the Certificate of Origin or bill(s) of sale.

- Bill(s) of sale or a junk receipt for the major component parts (engine, frame, transmission, and body).

- If a Certificate of Origin is submitted, it may be accepted as a bill of sale only for the parts described. However, a Certificate of Origin may be presented as evidence of ownership for a complete vehicle only if it is an unassembled trailer kit.

- If the vehicle was assembled from parts of a vehicle owned by the applicant, the applicant must have reported the vehicle “junked”.

- A Motor Vehicle Ownership Surety Bond (REG 5057) (PDF) if the vehicle value is $5,000 or more and the required receipts for the major component parts are not submitted.

- A Statement of Construction (REG 5036) (PDF) completed and signed by the owner. The total value on the REG 5036 must agree with the market value shown on the REG 343.

- An electronic Vehicle Safety Systems Inspection (VSSI) certificate. Refer to Chapter 19.090 Vehicle Safety System Inspection Program

- The VSSI certificate exemption, due to distance from an inspection facility, is being discontinued. When a VSSI station that inspects specific vehicles such as motorcycles and large commercial vehicles is not located within a reasonable distance, a Statement of Facts (REG 256) (PDF) form from a repair shop attesting that the brakes and lights are in proper working order is not acceptable.

- A VSSI certificate is not required for trailers weighing under 3,000 lbs. gross vehicle weight.

- Weight certificate for a commercial vehicle weighing less than 10,001 pounds.

- If the vehicle weighs 10,001 pounds or more, or if the vehicle is a trailer in the PTI program, the estimated unladen weight is required and must be shown on a Statement of Facts (REG 256) (PDF).

- Declaration of Gross Vehicle Weight/Combined Gross Vehicle Weight (REG 4008) completed and signed by the owner for a commercial vehicle weighing 6,001 pounds or more unladen.(Not required for pickups).

- Report of Sale, Used Vehicle (REG 51), if applicable.

- Smog certification, if appropriate.

- Fees due.

7.095 SPCNS Certificate of Sequence (VC §4750.1)

A SPCNS Certificate of Sequence allows an owner of a SPCNS vehicle to choose whether the smog requirements for the vehicle are based on the model year of the engine used in the vehicle or the year the vehicle is being registered.

- Each calendar year, a Certificate of Sequence is issued by DMV to the first 500 owners of specially constructed (SPCNS) vehicles who either:

- Present any type of registration transaction for an SPCNS vehicle

- Request issuance of a Certificate of Sequence only (when the vehicle is not subject to a registration transaction).

- After the 500 are issued each year, SPCNS vehicles will be evaluated for emission requirements by BAR based on the criteria for SPCNS vehicles. Contact a BAR referee for further information.

7.090 Specially Constructed Vehicles (VC §§580 and 4153)

A specially constructed vehicle (SPCNS) is a vehicle built for private use, not for resale, and not constructed by a licensed manufacturer or remanufacturer.

- Specially constructed vehicles may be built from a kit, new or used parts, a combination of new and used parts, or from a vehicle reported as dismantled, as required by VC §§5500 or 11520 which, when reconstructed, does not resemble the original make and model of the vehicle that was dismantled.

- A specially constructed vehicle does not include a vehicle which has been repaired or restored to its original design by replacing parts or modified from its original design, but not completely assembled from parts, which is still recognizable as the original make.

-

Example #1-A Volkswagen modified with a conversion kit to give the appearance of having the grill of a Rolls Royce is not registered as a specially constructed vehicle, because it still resembles and would be recognized as a Volkswagen.

This also applies to a Volkswagen modified with a “Baja Kit” in which the fenders, engine compartment lid, and possibly the front end, are modified, but leave the vehicle still recognizable as a Volkswagen. -

Example #2-A motorcycle, such as a Harley Davidson, modified only with extended forks but still recognizable as a Harley Davidson is not registered as a SPCNS.

However, if a motorcycle is constructed entirely from parts, even if they are Harley Davidson parts, the vehicle cannot be registered as a Harley Davidson since it was not constructed by a manufacturer or remanufacturer; it must be registered as a SPCNS. - Example #3-Vehicles that are modified by a body change only, when the Certificate of Title held by the owner shows the correct make, is not registered as a SPCNS.

-

Example #1-A Volkswagen modified with a conversion kit to give the appearance of having the grill of a Rolls Royce is not registered as a specially constructed vehicle, because it still resembles and would be recognized as a Volkswagen.

- All specially constructed (SPCNS) motor vehicles and SPCNS trailers weighing 6001 pounds or more unladen must be referred to the California Highway Patrol (CHP) for inspection and determination of, or assignment of a VIN.

- SPCNS trailers weighing less than 6001 pounds, except logging dollies, are assigned a VIN by the DMV unless the original unaltered VIN is on the frame.

Smog Certification

The first smog certification for a SPCNS vehicle must be issued by a Bureau of Automotive Repair (BAR) Referee Center.

- Once the vehicle is certified by the referee, a BAR label will be affixed to the vehicle.

- Any licensed Smog Check station may perform subsequent inspections as long as the BAR label remains in place and the vehicle’s emissions equipment remains the same.

SPCNS Registration Requirements

- Application for Title or Registration (REG 343) (PDF) or an alternative, completed and signed.

- Power-of-attorney may be used for the signatures of the registered owner.

- The cost information must include the materials and labor costs, even if provided by or done by the applicant. No year model is shown.

- Vehicle Verification (REG 31 (PDF)/REG 343 (PDF)), only if the application is a trailer and the original trailer VIN is on the frame; or the completed REG 124 from CHP or DMV, if the vehicle is other than a trailer.

- Statement of Construction (REG 5036) (PDF) completed by the owner. The total value of the vehicle as shown in Section 5, Cost Information and Vehicle Value, must agree with the cost information shown on the REG 343.

- Bills of Sale, receipts, and invoices for all major component parts (body, frame, transmission, and engine).

- A Manufacture’s Certificate/Statement of Origin is only acceptable as proof of ownership for the part(s) described.

- A junk receipt issued by DMV may also be submitted for the major component parts.

- Satisfactory evidence of ownership for the materials used in constructing the vehicle must be submitted as part of the application.

- Motor Vehicle Ownership Surety Bond (REG 5057) (PDF) or alternative, if the vehicle is built from either:

- An altered vehicle, or component parts of such a vehicle, registered or formerly registered in California or any state, or

- Materials not previously part of another vehicle to which a VIN plate is issued.

The penal sum of the bond (the dollar amount that the surety is liable for under the bond) must be equal to the amount of the fair market value of the vehicle, including parts and labor.

Note A Motor Vehicle Bond is not required if the documents submitted as evidence of the ownership identify:

- A verified VIN on the vehicle or the value of the completed vehicle, or

- Component parts (body, frame, transmission, and engine) for which bills of sale cannot be obtained, is $4,999 or less.

See Chapter 23, Bonds and Certifications, for additional information regarding bonds.

- An electronic Vehicle Safety Systems Inspection (VSSI) certificate.

- When a VSSI station that inspects vehicles, such as motorcycles and large commercial vehicles, is not located within a reasonable distance, a Statement of Facts (REG 256) (PDF) form from a repair shop attesting that the brakes and lights are in proper working order will not be accepted.

- An electronic VSSI certificate is not required for trailers weighing under 3,000 pounds gross vehicle weight.

Note Fleet owners who operate a licensed inspection and maintenance station may submit an electronic VSSI certificate from that station for a motor truck with three or more axles and an unladen weight of more than 6,000 pounds, or for a truck tractor.

- Weight certificate for a commercial vehicle weighing less than 10,001 pounds.

- If the vehicle weighs 10,001 pounds or more, or if the vehicle is a trailer in the PTI program, the estimated unladen weight is required and must be shown on a Statement of Facts (REG 256) (PDF).

- Declaration of Gross Vehicle Weight/Combined Gross Vehicle Weight (REG 4008) completed and signed by the owner for a commercial vehicle weighing 6,001 pounds or more unladen. (Not required for pickups).

- Smog certification, if appropriate, or a Certificate of Sequence and BAR referee datasheet, if applicable.

- All fees due. Use tax is not due if the owner who constructed the vehicle is registering the vehicle in their name.